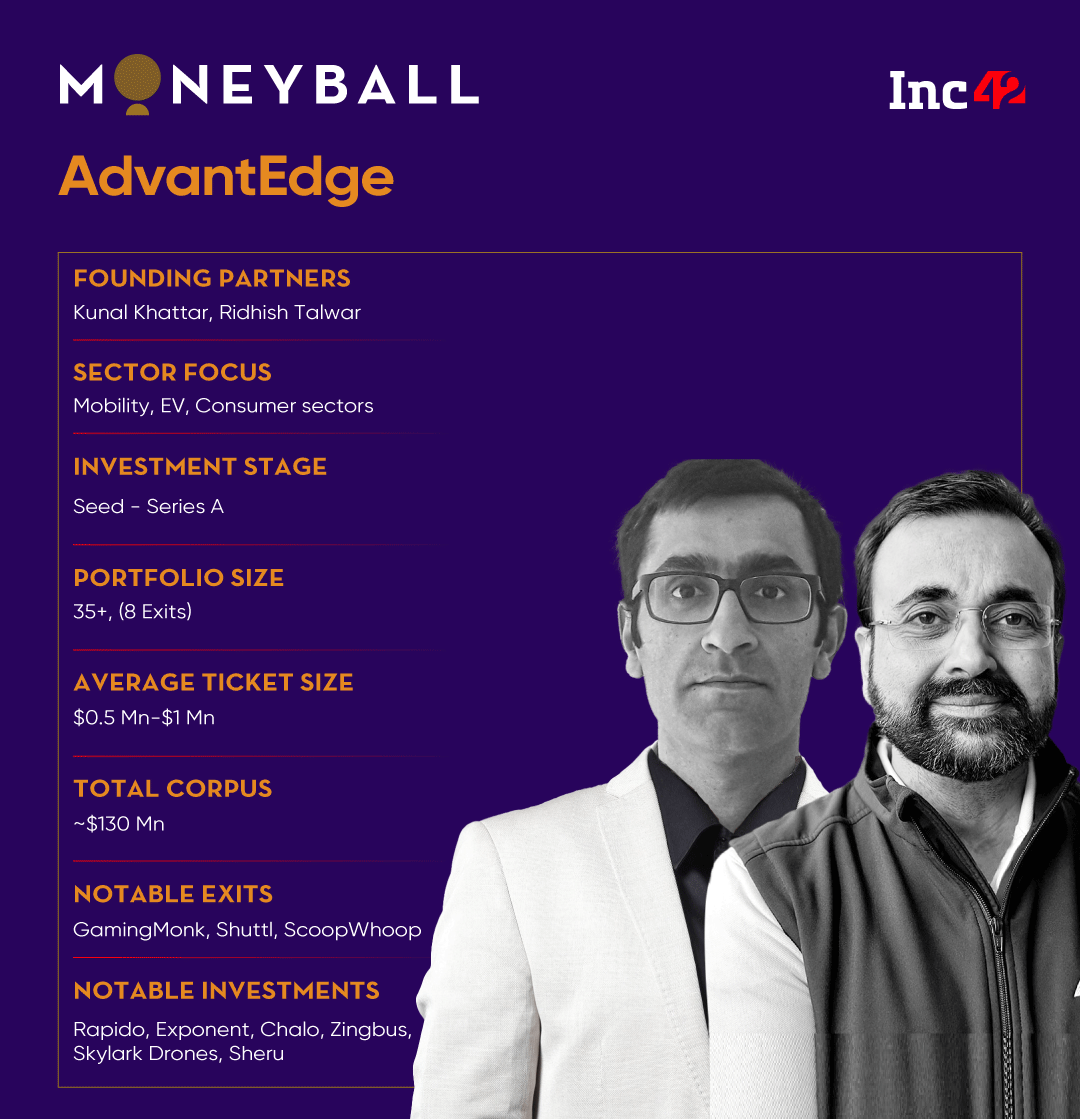

Founded in 2015, AdvantEdge, which boasts eight category leaders in mobility, including Rapido, Zingbus, and Chalo

The VC firm has made total investments of around $10 Mn from its Fund I and expects to ultimately deploy around $40 Mn in Fund II

AdvantEdge has also launched its third venture fund, in which it is looking to raise around $80 Mn

At a time when a majority of new-age sectors are bogged down in multiple macro challenges, including the ongoing funding winter, the electric vehicle (EV) space seems to be galloping comfortably. In fact, for mobility-focused early-stage venture capitalist (VC) AdvantEdge, India’s EV expansion vows have proven to be a golden goose to double down on its investments in the sector.

As part of Inc42’s Moneyball series, we spoke with Kunal Khattar of AdvantEdge and tried to understand his investment thesis, the potential he looks for before investing in a particular startup, and how he helps portfolio companies to find their product-market fit sooner than their counterparts.

As our conversational journey progressed, we stumbled upon quite an interesting moat, which made the VC firm’s portfolio startups survive the peak pandemic years when they failed to add even a single dime to their top line.

What we learnt has the potential to become the new buzzword, especially in the mobility space. According to Khattar, the mobility startups that were forced to close their garages, pivot or get acquired during the pandemic were largely the ones that were ‘asset-heavy’.

During the peak pandemic time, when their revenues plummeted to zero, many of them were still incurring losses on their balance sheets because of the depreciating assets and other related factors. On the contrary, AdvantEdge’s asset-light portfolio companies did not have to worry about growing losses, even though revenues were a major challenge.

Founded in 2015, AdvantEdge, which boasts eight category leaders in mobility, including Rapido, Zingbus, and Chalo, plans to stick to its investment thesis of investing in asset-light early-stage startups.

The VC firm has made total investments of around $10 Mn from its Fund I and expects to ultimately deploy around $40 Mn in Fund II, including co-investments. Its two upcoming investments are in a global logistics startup and an EV financing company, which will be funded by Fund II. AdvantEdge has also launched its third venture fund, in which it is looking to raise around $80 Mn.

After investing in eight EV companies, including fast-charging startup Exponent Energy, electric mobility platform Baaz Bikes, and EV charging infrastructure provider Park+, AdvantEdge is now looking further to grow its EV portfolio in the coming days.

“With our Fund III, we are looking to invest in at least 18-22 startups. We might do some investments across the mobility space but the priority, of course, would be the EV ecosystem,” Khattar said, adding that AdvantEdge is ready to bet on the players that have the potential to generate $100 Mn-$200 Mn in revenues in the next eight to nine years.

Refraining from revealing too much here, let’s learn directly from the horse’s mouth about his EV investment playbook and the moat the VC firm offers to its partner companies to outdo the competition and emerge strongly thereafter.

Here are the edited excerpts of our lively tête-à-tête with AdvantEdge’s Kunal Khattar…

Inc42: To start with, can you tell us about AdvantEdge’s journey and what inspired you to focus on mobility as your primary sector?

Kunal Khattar: My first job after business school was at Ford in the US, which gave me exposure to the automotive industry. I then worked in technology consulting, started two startups, and later moved into private equity.

In 2009, I started Carnation Auto with my father, who had previously worked at Maruti. This was when I gained a deep insight into the aftermarket automotive side, and over the next seven years we launched seven businesses, including the workshop business, used cars, car insurance, car finance, and spare parts. Through this experience, I learned about the challenges and opportunities in the auto industry.

After we sold the Carnation business to Mahindra, I considered my options and realised I wanted to continue as an entrepreneur. My father suggested that instead of building one successful company, I could help create 100 successful founders, which led to the founding of AdvantEdge.

With my automotive background and support from two large LPs from the auto sector — one member of the Hero family and the Motherson Group — we began exploring opportunities in mobility. While we were open to investing in companies outside of mobility, we identified interesting opportunities in the shared mobility space, especially as Uber and Ola were launching in India, but their price points were too high for most Indians to afford.

Therefore, we focused on form factors with a price point below $1, such as e-rickshaws, two-wheelers, buses, and three-wheelers. That’s how we started our journey.

Inc42: You have some of the leading mobility players in your portfolio. What are the standards that guide your selection of startups in a highly competitive mobility market?

Kunal Khattar: Initially, our focus was on affordable shared mobility startups that had the potential to scale. We have also been focused on investing in companies that are asset-light.

From my experience at Carnation, I learned about the challenges of asset-heavy businesses. When you’re a startup, you need to keep experimenting with the business model to achieve product-market fit (PMF). If you invest heavily in hardware, such as vehicles, infrastructure, or buildings before achieving PMF, it will become challenging to pivot your business model.

For this reason, we passed on several mobility companies, including Vogo, Bounce, and Zoom, when we saw that they had invested heavily in their fleets.

Inc42: The Covid-19 pandemic heavily impacted many sectors, with travel and mobility being among the worst affected. How has your focus on asset-light businesses helped you?

Kunal Khattar: During the pandemic, the ventures that were asset-heavy saw their revenues decline, while their expenses remained the same. It is because of this the runway of many asset-heavy companies shrank from 15 months to a mere five months.

Although asset-light companies, like Rapido and Zingbus, saw a dip in their revenues, their expenses declined too. They weren’t spending money on customer acquisition or incentives. So, their runway increased.

While, on the one hand, Covid-19 was bad for our portfolio companies as they all saw their revenues plummet to zero, but, on the other hand, it also allowed all of them to become market leaders. This is because other companies that were threatening or were competing with them either had to pivot, shut down or get acquired.

One such example is Bounce, which pivoted from being a ride-sharing business model to becoming an OEM. Similarly, Vogo got acquired.

Such examples reaffirm our decision to invest in asset-light companies.

Inc42: Do you have the same thesis in place when investing in EVs? How do you bet on EV startups with a long-term vision in mind given the industry is relatively more nascent and is undergoing significant changes?

Kunal Khattar: After four years of research, we realised that EV is not really a vertical but a horizontal opportunity. The other three verticals in our focus – the auto industry, shared mobility, and logistics – all of them are also going to get electrified.

If you add it all up, we’re expecting this to be a $1 Tn revenue opportunity in the next 10 years. We are expecting 50% of all new vehicles to be electric in the next 10 years across categories. Each of these will have new OEMs.

Also, EVs use 96% fewer components than ICE vehicles. So, there will be a disruption in the component size. If you look at the overall auto industry, there is going to be electrification across the sector. Now, the entire value chain of the auto industry contributes to almost 10%-12% of India’s GDP.

If I look at shared mobility, companies like BluSmart are forcing Ola and Uber to become electric. Food delivery companies are saying that in the next three-four years they want 100% of their fleets to be electric. Amazon and Flipkart are emphasising the need for 100% of the fleet of its 3PL logistics player to be electric.

So, we are seeing rapid adoption of EVs in the commercial use case – whether it’s logistics or personal mobility. In this market, we are trying to identify 8 to 10 companies that can build a $100 Mn-$200 Mn top line in the next eight to nine years – and that is our thesis on EVs.

If we look at the agricultural sector, today 100% of tractors are diesel. Our thesis is that once you have good quality electric tractors available, anybody looking to buy a tractor will buy an electric tractor over a diesel one given its economic viability. EV adoption in the agricultural sector will be so fast that we are currently unable to fathom it.

Also, just like we avoided asset-heavy businesses so far, we’re avoiding investments on the OEM side because we don’t think that should be the right investment focus for a venture fund.

We are rather focussing on infrastructure players and the companies that are enabling this transition to happen. We want to become suppliers and partners to OEMs. Hence, we want to invest in areas like EV components, charging, energy bank, financing, leasing, and more such enablers of the EV ecosystem.

Inc42: What is the kind of evolution you witnessed in the mobility space since you began your journey?

Kunal Khattar: To start with, shared mobility was the core thesis for Fund I. We made six to seven investments in that area. Out of them, four became the market leaders.

For Fund II, we tried expanding the scope and added three verticals. While we continued to look for opportunities in the shared mobility space, we added logistics, auto aftermarket, and EVs to our portfolio.

Our first investment in the EV space was in 2018 from the first fund. Then we paused, which helped us analyse the opportunity that was being created in the EV space, and then we started deploying capital from the second fund.

Also, when I say we are looking to invest more in EV infrastructure companies, it doesn’t mean capital-heavy infrastructure. I am talking about the technology-centric businesses that will be complementary to the traditional mobility industry transitioning to EVs.

Parallely, we will continue to look for opportunities in auto and shared mobility. However, I am not sure if there are any potential opportunity to look at. If something comes up tomorrow, we will definitely look at it as well.

Inc42: Take us through the process of how you select potential portfolio companies?

Kunal Khattar: Since we are sector focused, we spend two-three years researching a space. Then we identify gaps in businesses, which have the potential to become $100 Mn-$200 Mn revenue companies.

After that is done, we start looking for the right teams to build these businesses. The reason we think we get to succeed is because these businesses have the ability to leverage our other portfolio companies critical to them.

For example, if an existing ICE mobility company wants to turn electric, it can procure the battery technology from one of our portfolio companies, financing can come from another portfolio company, and so on. They probably can launch a service or get to market 80% faster than anybody else who is trying to figure out these all by themselves. If you can launch fast, you can get PMFs, you can raise capital and your probability of becoming a market leader goes up.

Inc42: What about conducting due diligence when it comes to investing in startups? How do you verify their projections and goals?

Kunal Khattar: In my experience, I don’t think there was even a single company that delivered on all the numbers that they had projected. Founders, by their very nature, are very optimistic and they assume that the financial models they are building on a spreadsheet can be replicated on the ground.

But in a country like India, especially if you’re in a disruptive category or in a space that is still a work in progress (for example: rapid charging), there are a lot of unknown factors at play. And often there are a lot of things that you need to create a successful product or business but they don’t exist, hence, you have to build them yourself.

We also call this a first-mover disadvantage (pun intended) rather than first-mover advantage. We keep backing them irrespective of such challenges.

We have no problems backing a failed founder twice. I will say 50% of our portfolio companies comprise founders who actually failed in one of their ventures. What is important is recognising what is not working and understanding if there’s a need for a course correction.

In fact, 50%-60% of our portfolio companies ended up doing businesses which were totally different from what we initially signed up for.

Inc42: How did the macroeconomic downturn impact AdvantEdge?

Kunal Khattar: Our speed of investment hasn’t really accelerated or slowed down with the macro. Roughly, we end up doing about four to five investments every year. Sometimes we end up doing two in a quarter and sometimes there’s none. The pace has remained consistent.

From Fund II, we made 17 investments over a period of three-and-a-half years. In fact, we have two new upcoming investments — one in the global logistics space and the other one in an EV financing company.

We will make as many investments as we can and as long as we have favourable opportunities coming to us. Notably, the quality of themes that we have seen in the last two years has definitely gone up compared to the first two years when we started operating.

Inc42: By when do you expect to close Fund III?

Kunal Khattar: We are not in a rush. As per SEBI norms, we have three years to close the fund, so we will take time. Also, we still have a lot of dry powder from Fund II, which we are still deploying.

Rather than a timeline, we actually want the right strategic LPs to come on board. We have a list of about 12 LPs, we’ll start reaching out to them now. We have a lot of work ahead of us as we expand the number of LPs we work with.