Startups that came into existence after 2015 are becoming unicorns in just 3.5 years, according to Inc42

The ecommerce sector boasts 25 unicorns, with Flipkart (now acquired by Walmart) being the most-valued unicorn at $37.3 Bn. Close on the heels are fintech and enterprise tech sectors, which foster 23 and 22 unicorns, respectively

83% of Indian unicorns that are headquartered outside India are from the enterprise tech sector. Overall, 18% of Indian unicorns are headquartered outside India, with the US being their most preferred destination

The world’s third-largest startup economy is going through some of the most precarious times and any respite from the ongoing funding winter seems to be only on the cards. As a result, not even a single startup has emerged to claim the unicorn title so far this year.

The state of the funding in the ecosystem is such that in the first seven months of 2023, Indian startups could only raise $5.9 Bn against $19.7 Bn and $21.2 Bn during the same period in 2022 and 2021, respectively.

According to data compiled by Inc42, late stage startups raised $3 Bn across 52 deals between January and July 2023, down a staggering 75% from approximately $12 Bn raised in the same period a year ago, and 82% from $16.6 Bn raised between January and July in 2021.

Adding to this are the ongoing market corrections and roiling global economies that have only made investors embrace more caution. Companies are now grappling with increased scrutiny of their business models and are being pressed to showcase profitability over pursuing rapid strides.

Consequently, once-promising ventures that were destined to become unicorns are today facing limited investment opportunities, while existing unicorns are struggling to sustain their current valuations.

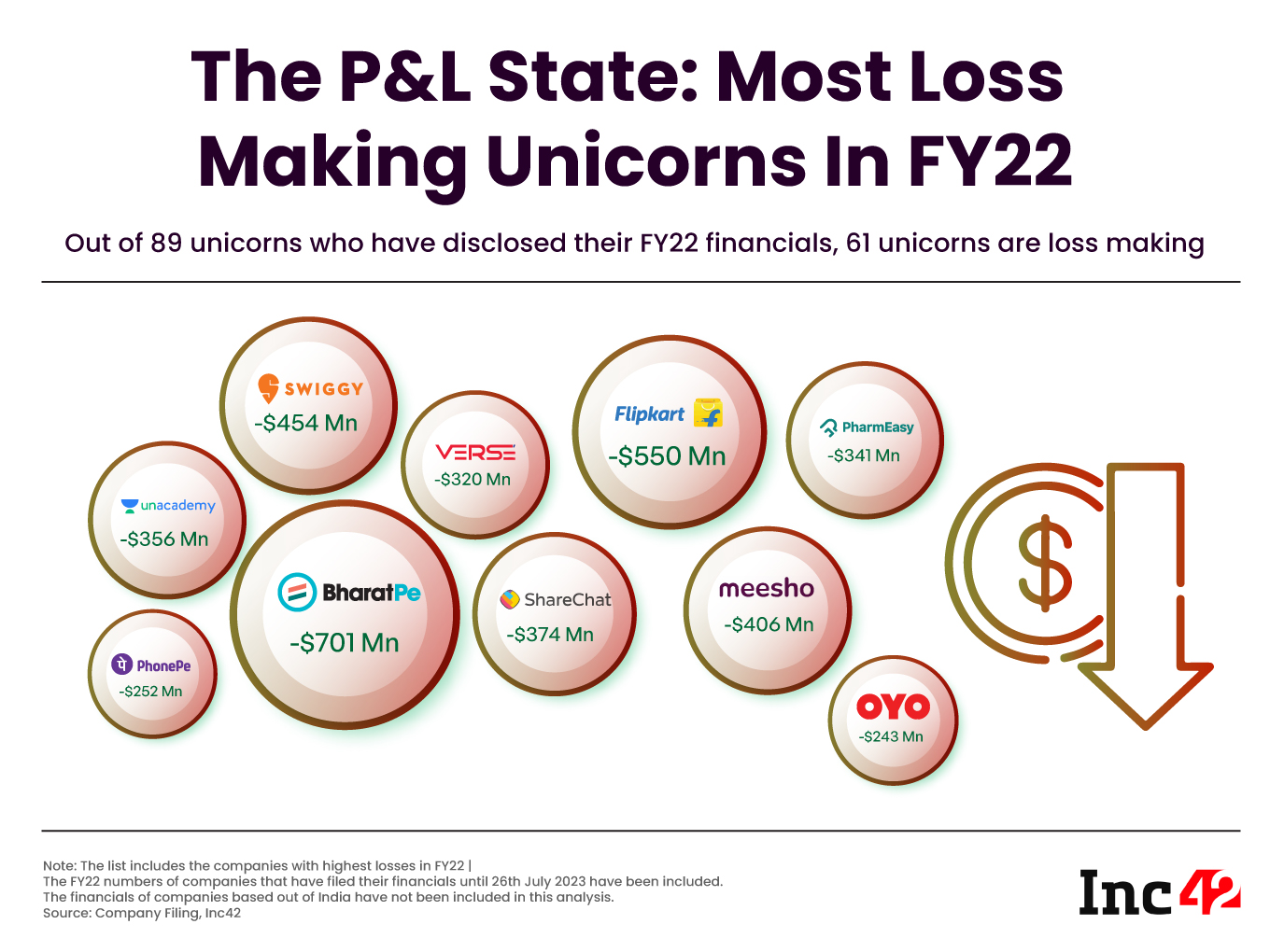

Recently, renowned Indian startup names such as OYO, BYJU’S, Swiggy, PharmEasy, PineLabs, Meesho, and Ola saw substantial valuation markdowns on the books of their investors due to their never-ending tryst with losses and cash burn.

BYJU’S, which has not reported its FY22 financials, witnessed a nearly 20X YoY increase in its consolidated FY21 loss to INR 4,588 Cr. Similarly, Swiggy’s FY22 consolidated net loss doubled to INR 3,628.9 Cr, and PharmEasy incurred losses to the tune of INR 2,731 Cr in FY22 compared to INR 641 Cr in FY21.

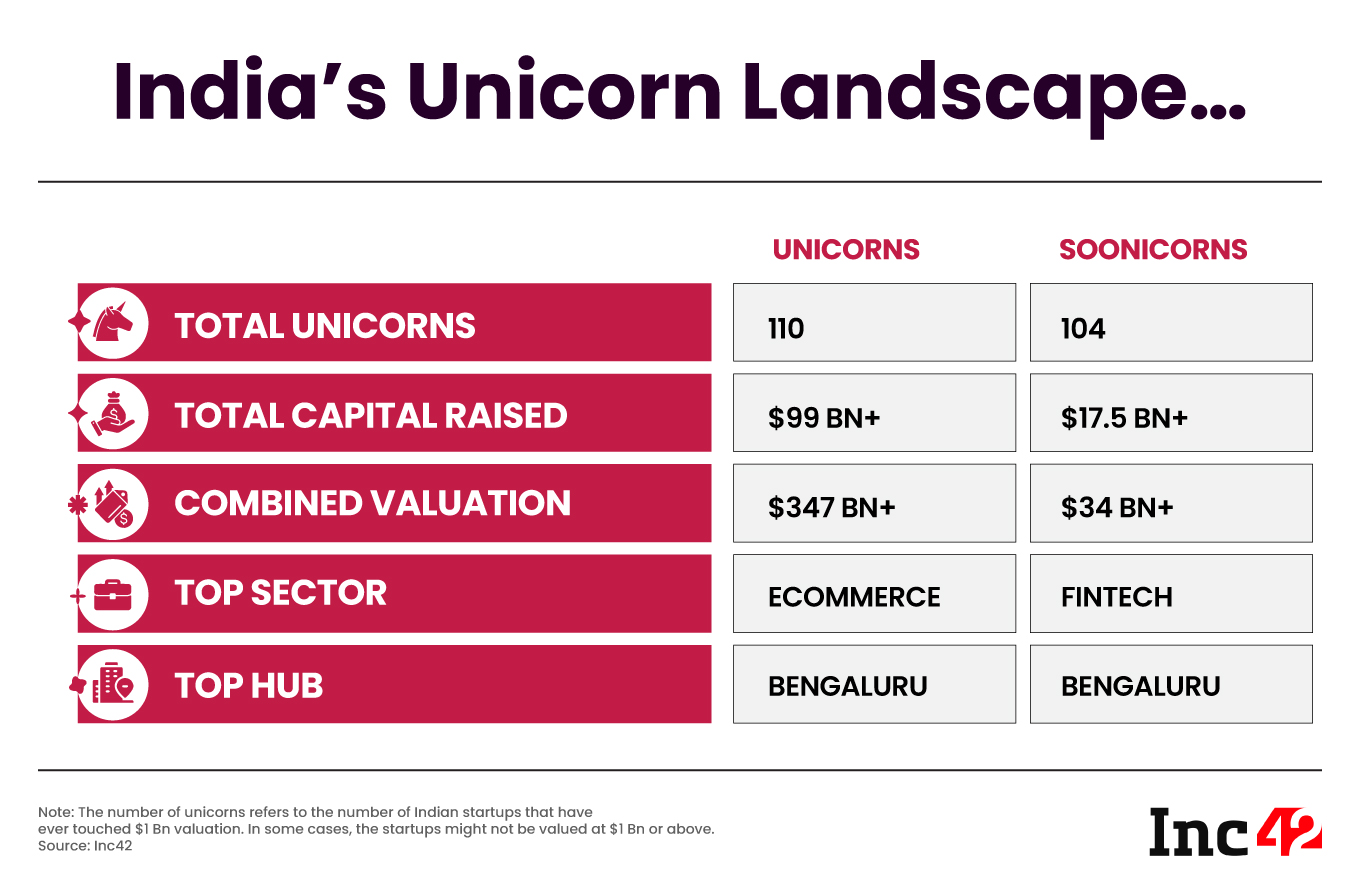

Nevertheless, India’s position as the ecosystem with the third-highest number of unicorns globally, after the US and China, remains undisputed. The collective valuation of the 110 startups exceeding $1 Bn valuation stands at over $347 Bn+, backed by total funding of $99 Bn. Further, as of April 11, 2023, the homegrown unicorn ecosystem employed more than 4.5 Lakh individuals, according to Inc42’s ‘Decoding India’s Unicorn Club Report 2023’.

Now, before we dive deeper into the findings, let’s quickly look at some unique facts from our latest report.

Now, before we dive deeper into the findings, let’s quickly look at some unique facts from our latest report.

- Time Taken To Become A Unicorn Has Reduced Significantly: Unlike companies like Fractal, Pine Labs, MapmyIndia and IndiaMART, which took more than 20 years to become unicorns, names like Mensa Brands, GlobalBees and 5ire ended up cherishing the coveted tag within just one year of their inception.

- Startups Founded Post-2015 Are Becoming Unicorns Faster: Startups that came into existence after 2015 ended up with the fancy unicorn tag in just 3.5 years. Names like Ola Electric, CRED, MPL, and Zetwerk took not more than 3 years to become unicorns.

- Sectors With The Highest Number Of Unicorns: The country’s ecommerce sector boasts 25 unicorns, with Flipkart (now acquired by Walmart) being the most-valued unicorn at $37.3 Bn. Close on the heels are fintech and enterprise tech sectors, which foster 23 and 22 unicorns, respectively.

- US Is The Most Preferred Destination For Indian Unicorns: According to the report, 83% of Indian unicorns that are headquartered outside India are from the enterprise tech sector. Overall, 18% of Indian unicorns are headquartered outside India, with the US being their most preferred destination.

- Most Unicorns Lack Gender Diversity At The Board: Of the 110 unicorns in the country, only two unicorns, Open Bank and Good Glamm Group, have more than one woman cofounders.

- Investors Are Now Looking Beyond IIT And IIMs: 51.8% of unicorn founders are non-IITians.

Profitability Still A Distant Dream For Most Unicorns

Out of the total 89 unicorns that disclosed their financials in FY22, only 23 were profitable. This number is slightly lower compared to FY21 when 29 unicorns boasted healthy profits.

Over the years, a combination of factors inherent to the startup ecosystem and specific market conditions have propelled unicorns towards aggressive growth strategies, often resulting in cash burn and financial losses.

An ever-intensifying competition and rapidly evolving technologies have pushed company founders to prioritise rapid expansion over achieving positive unit economics. Concurrently, the inflow of continuous funding from the investor ecosystem, driven by inflated valuations based on exaggerated total addressable market (TAM) estimates, led founders to bloat their fixed costs, including human resources, manufacturing facilities, and office spaces.

Consequently, when the funding stream dwindled, many of these startups found themselves in precarious situations.

According to Inc42’s Layoff Tracker, more than 100 startups have laid off 28,000-plus individuals in the past 20 months. Prominent unicorns like BYJU’S, Ola, Unacademy, and Blinkit have been among those resorting to significant workforce reductions. This period has also been marked by controversies, impacting unicorns like PharmEasy, Swiggy, BYJU’S, and BharatPe.

It is due to these setbacks, including amplified market volatility, that many startups are deferring their plans to go public. Further, what has cornered Indian startups, including unicorns, on all fronts has been desperate attempts to cut costs by laying off employees and their tryst gone wrong with Indian regulators on multiple occasions, throwing them off the growth path and subjecting them to uncertainties.

Is There Light At The End Of The Tunnel?

Even though the prevailing funding dry spells pose a severe challenge to Indian startups, these are also acting as a crucible to forge resilience and innovation among companies. In the absence of any major funding support, these startups are expected to not only stay laser-focussed on being profitable but also build sustainable business models.

The latest example in this context is of foodtech giant Zomato, which has finally reported a net profitable quarter. In the first quarter of the financial year 2023-24 (FY24), the company recorded a consolidated profit after tax (PAT) of INR 2 Cr. Further, its acquired unicorn entity Blinkit is targeting to break even on an adjusted EBITDA basis in the next few quarters.

Meanwhile, Meesho, too, has also reported a consolidated profit after tax (PAT) as of July 2023. However, it has yet to file its financial results.

Furthermore, the fintech heavyweight Paytm’s Q4 FY23 net loss plummeted 78% YoY to INR 167.5 Cr, accompanied by a remarkable 51% YoY surge in operating revenue to INR 2,334.5 Cr in Q4 FY23.

As of now, industry experts foresee a temporary improvement in financials, given the widespread adoption of cost-cutting measures by companies in FY23. However, valuations are expected to remain under consistent pressure.

Concurrently, the quest for exits might drive several funds to explore potential merger and acquisition opportunities for their portfolio unicorns. Currently, Tiger Global Management and Peak XV Partners possess the highest number of shares in unicorns at 39 and 37, respectively.

Nevertheless, in the ebbs and flows of business cycles, hope persists. Inc42 projects that India will be home to over 280 unicorns by 2030. Notably, between January 2021 and August 2023, 240+ India-focussed funds emerged, collectively wielding $33 Bn in dry powder to bolster the future of the world’s third-largest startup ecosystem.

Download The Report