Traditionally, the LP investing space in India has been a closed network characterised by exclusivity, discretion, and loyalty

LPs are concerned about challenges faced by first-time fund managers, including a lack of track record in the young Indian alternative investment market, higher risk appetite, limited fund size, less favorable fund terms

First-time fund managers must possess a strong team with relevant experience, deep market understanding, precise portfolio management, and demonstrate alignment of interests to stand out in the competitive LP capital landscape

Venture capital is an exhilarating yet risky asset class offering tremendous upside for limited partners (LPs) that pursue it. It allows LPs to be part of the next biggest innovation that could disrupt existing products and businesses.

However, along with the thrill of investing in the next big thing and supporting innovation, it is also plagued by the lack of liquidity in the initial years deterring several from pursuing it.

The LPs who pursue it often invest in experienced fund managers with a demonstrated history of returning capital. Nevertheless, a set of new first-time fund managers and solo GPs have emerged globally in the last few years, bringing differentiated views to the table.

Prominence Of Domestic LPs In The Rapidly Expanding Venture Capital Industry

Traditionally, the LP investing space in India has been a closed network characterised by exclusivity, discretion, and loyalty. These LPs typically include UHNIs, HNIs, family offices, and leading institutional investors. The limited number of LPs in India is primarily due to lower awareness, regulatory challenges and risk perception among conservative investors.

Access to low-quality opportunities and cultural preferences for direct investments or traditional asset classes like stocks, real estate, and gold also prevent many from entering in this arena. Nevertheless, as awareness increases, regulatory frameworks evolve, and the startup ecosystem matures, the number of LPs in India is expected to grow, unlocking more domestic capital in alternative asset classes like venture capital.

However, as the number of LPs increases, most pursue the same experienced fund managers. According to a report on family offices by SVB, several potential family offices surveyed had yet to invest in diverse GPs, and some showed no interest in doing so. This preference for proven fund managers and established relationships highlights the emphasis placed by LPs on accessing trending deals and avoiding complexities while diversifying their investments across different asset classes.

Despite the potential for higher returns, most LPs are concerned with certain challenges that first-time fund managers and solo GPs face. These challenges include a lack of track record in the relatively young Indian alternative investment market, potentially higher risk appetite, limited fund size, less favourable fund terms, and concerns about solo GPs carrying the full responsibility of managing the fund. Additionally, LPs may need to be reassured about the manager’s commitment to the fund, which might hurt the investment performance of a VC in many ways.

Growing Presence Of Solo GPs and First-Time Fund Managers

Solo GPs have become increasingly notable in the startup ecosystem in recent years. Their unique characteristics bring remarkable advantages to the investment environment, and founders often appreciate their investment style. According to a report created by AngelList, solo GPs were involved in about 51% of all top-tier, early-stage deals in the United States in 2020.

Furthermore, seven out of the top twenty external co-investors on the AngelList platform in Q3 2021 were solo GPs. The ability of these solo VCs to compete with traditional VC firms on such a scale underlines their increasing relevance and value in the investment landscape.

One significant advantage of solo GPs is their ability to make unilateral decisions. This helps improve execution speed which often equates to winning a competitive deal in the market. Traditional venture capital firms can be delayed by internal protocols and decision-making structures; in contrast, solo VCs can move more quickly and come to a final discussion in a shorter period of time.

Personal branding also plays a critical role in the value proposition of solo GPs. The personal brands built by solo GPs through social media and other content platforms are generally far more than multiple GP firms. This allows solo GPs to enter at lower valuations in early-stage companies within areas of expertise.

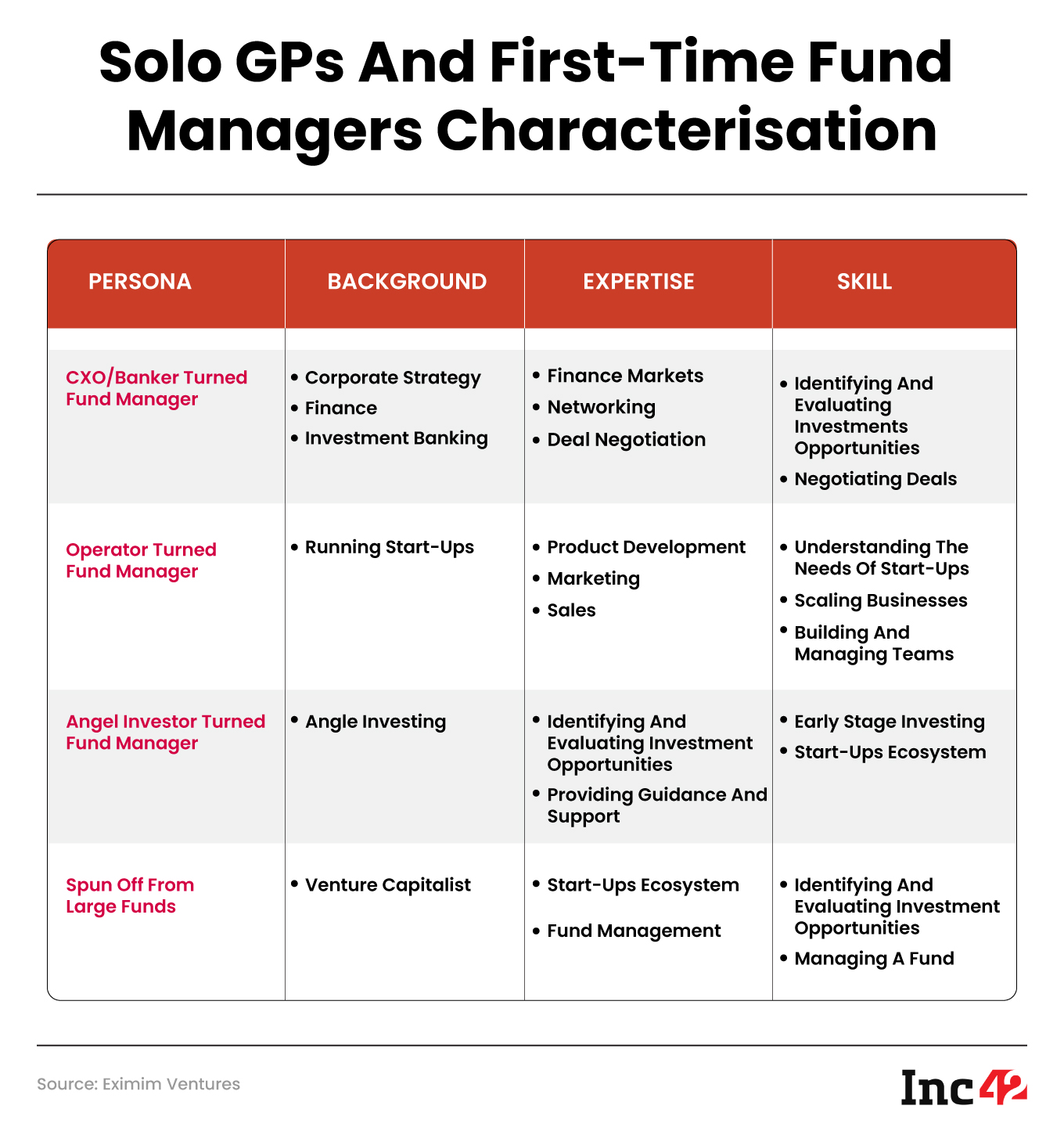

First-Time fund managers and solo GPs typically can be categorised across four different personas based on their backgrounds and skill set:

- (i) CXO/banker turned fund managers

- (ii) Operator turned fund managers

- (iii) Angel investor turned fund managers

- (iv) Those with specialised expertise or unique investment strategies learnt from their previous franchise. Successful fund managers possess a combination of expertise, experience, and a strong network, enabling them to identify and support promising investments.

What Do LPs Look For In First-Time Fund Managers?

In today’s highly competitive LP capital landscape, despite a strong network and expertise, first-time fund managers face the challenge of differentiating themselves from their peers. Hence, they need to ensure that they have the critical items that LPs are looking for:-

- Team and the General Partner with prior experience in managing funds, operating skillset and industry knowledge.

- Deep market understanding and solid investment thesis backed by primary and secondary due diligence.

- Precise portfolio construction and management strategy to deliver strong returns while managing risks.

- Alignment of interest and “Skin in the game” to show long-term commitment to the fund and LP interests.

The enthusiasm and fresh perspective that first-time fund managers bring to the table is unparalleled. They have a hunger for success and a passion for identifying game-changing startups driven by the desire to make a mark in the industry. They are willing to go the extra mile to unearth the next unicorn by building strong networks and adopting a founder-friendly approach. Moreover, they tend to be agile and flexible without the burden of legacy systems and processes, adopt differentiated strategies, and bring speed to execution, similar to the startups they invest in.

Hence, investing in first-time fund managers and solo GPs in India offers a unique chance to participate in the growth of the startup ecosystem while supporting innovative approaches in deal-making. In fact, as per Pitchbook, first-time fund managers between 2012-14 vintages were able to generate ~40% higher returns than follow-on funds. With careful evaluation and due diligence, LPs can strategically allocate capital, support innovative startups, and achieve higher financial returns by supporting new-age fund managers.