Valuing disruptive startups poses challenges due to unique business models and lack of historical financial data

Alternative valuation methods include scorecard valuation, Berkus method, and incorporating non-financial metrics and intangible assets

Venture capital exit method and reverse option pricing approach are also effective in valuing startups accurately

The startup landscape has disrupted several business models, the impact of which we see on the operations of several businesses today. This is largely attributed to the rapid development of technology, especially in the fields of blockchain, AI-based platforms, robotics, and machine learning, in addition to the development of virtual reality and augmented reality applications.

As a result, valuing these startups and their innovative technology platforms that defy conventional valuation wisdom has become a critical challenge for appraisers and investors. That said, certain tools and methodologies help better comprehend the art of startup valuation and the technology factors that drive value.

Fundamental Approaches Of Valuation

Traditionally, businesses have been valued using three fundamental approaches: the market approach, the income approach, and the cost approach.

The market approach essentially benchmarks valuation multiples derived from financial metrics such as revenue or EBITDA to that of publicly listed companies as well as recent transactions for comparable businesses. The income approach (discounted cash flow) leverages the projected future cash flows discounted for their riskiness to conclude an enterprise’s value. The cost approach determines the value of a company’s assets based on the cost to recreate or replace them.

These traditional valuation approaches have limitations when assessing the potential of startups with disruptive innovations. Valuers should consider several key factors in assessing the potential of startups:

Analysing The Potential Of Disruptive Innovation Or Startups

- The scalability of the technology is important, i.e. to determine if the technology can be easily expanded to meet the demands of a large market.

- Understanding the competitive landscape and assessing whether the technology is difficult to replicate.

- The market opportunity should be thoroughly analysed, including assessing the market’s size and growth.

- Evaluating the management team’s composition, expertise, ability to think innovatively, and potential for forming strategic partnerships.

- Testing for the long-term focus of the company when evaluating startups, as they may involve higher risks but also hold the potential for significant long-term returns.

- Ascertaining if the laws and regulatory conditions are favourable for the technology to thrive.

Let us consider a case study of Airbnb, an online marketplace that allows people to rent out their properties to travelers. To assess the potential of Airbnb, we need to understand its business plan and platform. Airbnb developed a robust and scalable technology infrastructure that could handle a large volume of listings, bookings, and transactions.

Due to Airbnb’s significant investment in technology and infrastructure, including advanced algorithms and data analytics, it becomes challenging for competitors to enter their market and diminish their market share. These investments have enhanced the user experience, provided personalized recommendations, and increased customer engagement.

As a result, it is difficult for competitors to replicate Airbnb’s success and make a significant impact in their competitive space. Airbnb has an experienced management team with Brian Chesky, Nathan Blecharczyk, and Joe Gebbia as its cofounders. They founded the company in 2008 and under Chesky’s leadership, Airbnb grew from a small startup to a multi-billion-dollar company.

The platform has expanded globally, offering millions of listings in over 200 countries and regions. Furthermore, the team has a long-term focus on introducing sponsored listings and an advertising network as potential avenues to generate additional revenue for the company.

Transcending Conventional Metrics: Embracing An Innovative Approach

For companies in their early stages, it is difficult to predict future cash flows accurately, accounting for both specific and systematic risks, and capture the changing risk-return profile as time goes on. To resolve this, certain methods that heavily rely on operational indicators, such as customer count or click rates, aim to compensate for the lack of information or readiness regarding the operational business model of a startup, including its organizational and cost structures.

Methods based on financial indicators, such as revenue and EBITDA, face the challenge of no/low revenue or negative earnings during the initial phase of losses as startups focus on developing and refining their products or services. In other words, the unique innovation brought by a particular startup cannot be adequately captured by comparing it with other companies using price multiples, as their business models are inherently distinct.

Furthermore, startups/early-stage companies lack historical financial data, making it challenging to evaluate their financial performance and growth potential. These challenges collectively make it crucial for investors and stakeholders to employ innovative approaches and adapt valuation methodologies to accurately assess the worth of startups.

Emerging Alternative Startup Valuation Methods

- Scorecard valuation method: The scorecard valuation method, also known as the Bill Payne valuation method, involves comparing the target startup with other similar startups that have received funding based on various factors such as their stage of development, market segment, and geographic location.

- Berkus method: The Berkus method is a valuation approach that emphasizes the potential rather than the current performance of a startup. First, an estimate is made of the total cost incurred in developing the startup’s product or service. Next, the value of the startup’s intellectual property is assessed. This encompasses any patents, copyrights, or trademarks that the startup possesses and adds value to its offerings. Finally, the two values of development cost and intellectual property value are combined to determine the overall value of the startup.

- Incorporating non-financial metrics and intangible assets: Valuation models should include non-financial metrics and intangible assets to capture the unique value of startups such as user engagement, website traction, intellectual property, team experience, brand recognition, and regulatory environment. These metrics may include user bases or customer-related factors such as the number of active users, customer acquisition costs (CAC), customer lifetime value (CLTV), churn rate, or average revenue per user (ARPU). These metrics may include product-related factors such as product usage rate, customer satisfaction score (CSAT), net promoter score (NPS), or product development cycle time.

- Venture capital exit method: This method is based on the valuation that a company could command after a few years of business scale-up. Market-based valuation metrics such as EV/revenue and EV/EBITDA are used to value the business. The future value is then discounted back to the present based on the VC rate of return to arrive at enterprise value.

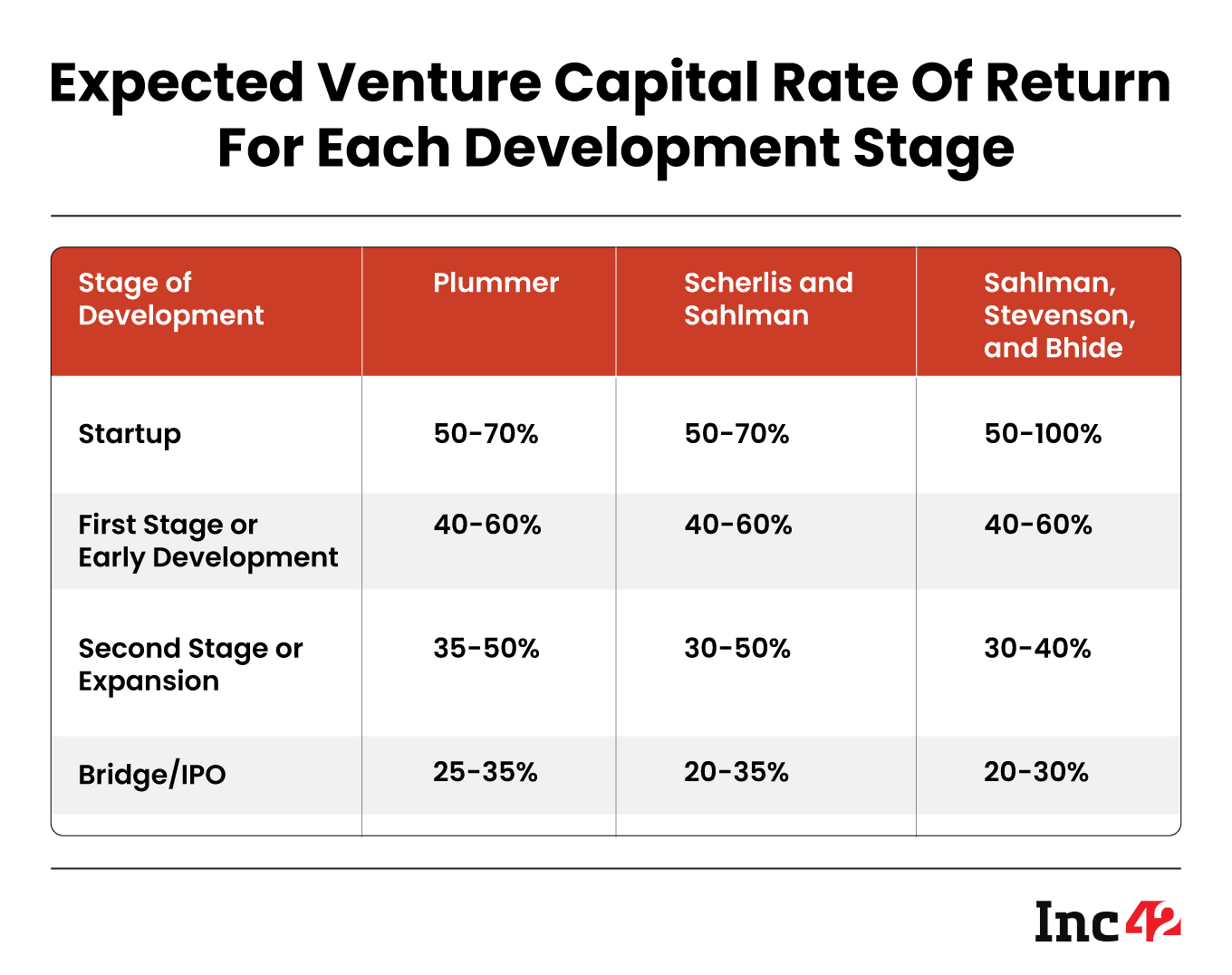

- Venture capital rate of return: When evaluating the potential returns on investment and considering the risks associated with startups, venture capitalists investing in early-stage companies often rely on polls to estimate the expected rates of return. Academic research and empirical evidence can provide valuable insights into relevant discount rates. These rates vary depending on the development stage of the company. Notably, these discount rates may seem high but reflect the substantial failure rates often experienced by early-stage companies. The table below offers a summarized overview of selected studies, outlining the expected returns for each development stage.

- Reverse option pricing approach (Backsolve approach): The method is considered a reliable indicator of fair value since it benchmarks the original issue price (OIP) of the company’s latest funding transaction. This is based on the premise that the OIP is a result of rational negotiations and comprehensive due diligence by sophisticated financial investors, inherently making it a fair market valuation.

On Concluding Note

In times of technological disruptions, since every startup is unique, valuing a startup poses challenges. Therefore, to appropriately determine the worth of these startups, a dynamic and flexible strategy is required, and it necessitates readiness to embrace innovative valuation methods that can accurately represent the promise and risks involved in these ventures.

[Contributed by Ankita Poddar, Manager – Valuation and Advisory, Aranca]