Navi Finserv, the subsidiary of IPO-bound Navi Technologies, reported a loss of INR 67 Cr in FY22 after posting a net profit of INR 97.5 Cr in FY21

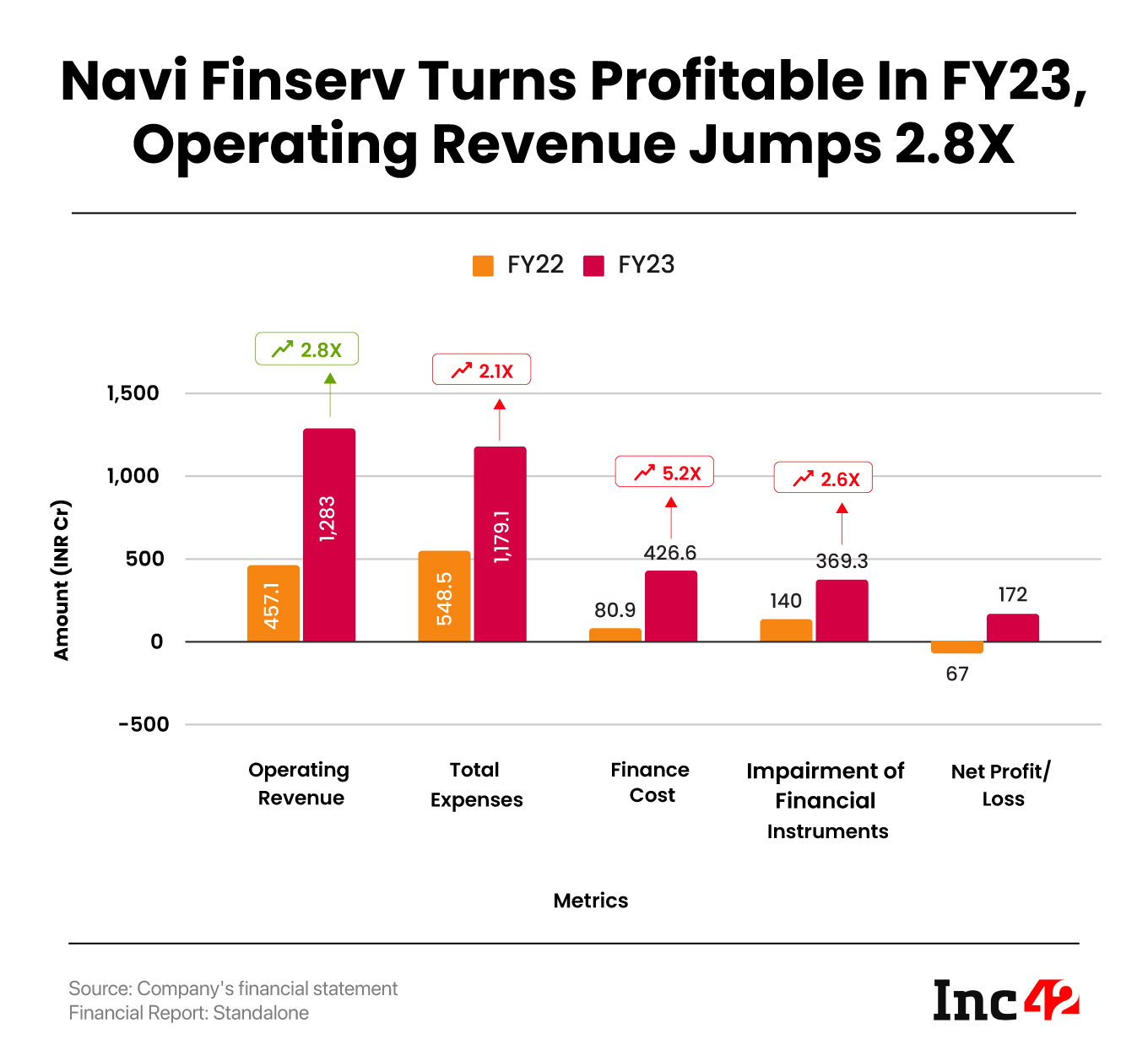

The startup’s operating revenue surged 2.8X to INR 1,283 Cr in FY23 from INR 457.1 Cr in FY22

Navi Finserv’s net profit grew to INR 26.2 Cr in June quarter of 2023 from INR 22.9 Cr a year ago but declined from INR 98.2 Cr in the quarter ended March 2023

Flipkart cofounder Sachin Bansal-led fintech startup Navi Technologies’ subsidiary Navi Finserv reported a net profit of INR 172 Cr in the financial year 2022-23 (FY23) as against a loss of INR 67 Cr in the prior fiscal year.

Navi Finserv had posted a net profit of INR 97.5 Cr in FY21.

The startup’s operating revenue also surged 2.8X to INR 1,283 Cr in the reported period from INR 457.1 Cr clocked in FY22.

Meanwhile, in the quarter ended June 2023, Navi Finserv’s net profit grew to INR 26.2 Cr from INR 22.9 Cr in the corresponding period of the previous year.

However, the startup’s net profit witnessed a sequential decline in the June quarter from INR 98.2 Cr reported in the quarter ended March 2023.

Navi Finserv’s operating revenue jumped over 138% year-on-year (YoY) and 6.3% sequentially to INR 438.7 Cr in the June quarter.

The key subsidiary of IPO-bound Navi Technologies primarily focuses on loan products, including personal, vehicle, and home loans. The subsidiary was incorporated on February 14, 2012 and has an NBFC licence.

Navi Finserv was converted to a public company in March last year.

While publishing its FY23 and June quarter results, the company said its board has approved borrowing up to INR 4,000 Cr by issuance of non-convertible debentures (NCDs) on a private placement basis and up to INR 1,500 Cr via commercial papers (CPs).

As per a report last month, Navi Finserv was looking to raise up to INR 500 Cr through a public issue of NCDs whose subscription was open between July 10 and July 21.

On the expenditure front, Navi Finserv’s total expenses grew 2.1X YoY to INR 1,179.1 Cr in FY23. In the quarter ending June 30, 2023, the startup’s total expenses stood at INR 405.2 Cr.

Finance cost accounted for the biggest portion of expenses in FY23 as well as the quarters ended March and June 2023. In FY23, Navi Finsev’s finance cost surged over 5X to INR 426.6 Cr from INR 80.9 Cr in the previous fiscal.

The startup’s expenses towards impairment of financial instruments also jumped 2.6X YoY to INR 369.3 Cr in FY23.

On the other hand, Navi Finsev’s employee benefit expenses continued to rise. In FY23, the company spent INR 84.5 Cr towards it, up from INR 49.7 Cr in the previous fiscal.

In the June quarter of 2023 alone, its employee benefit expenses stood at INR 31.6 Cr as against INR 24.3 Cr in the preceding quarter.

The NBFC’s parent company Navi Technologies incurred a loss of INR 362 Cr in FY22 due to lacklustre performance of Navi Finserv and its insurance business Navi General Insurance.

In September last year, Navi Technologies received approval from the Securities and Exchange Board of India (SEBI) for its INR 3,350 Cr IPO. However, the startup is yet to launch its public offering.

Last month there were reports that Navi Technologies fired around 200 employees across departments, joining over 110 other Indian startups that have laid off their employees since 2022 amid a funding crunch and market volatility.

Ananya Birla-led Svatantra Microfin Pvt Ltd said earlier this month that it was set to acquire Navi’s subsidiary Chaitanya India Fin Credit Pvt Ltd for INR 1,479 Cr.