ZestMoney’s success was once synonymous with India’s tryst with the BNPL market, which witnessed significant growth during the pandemic

However, soon the company fell into a debt trap due to growing NPAs, sub-par collections and a faulty business model

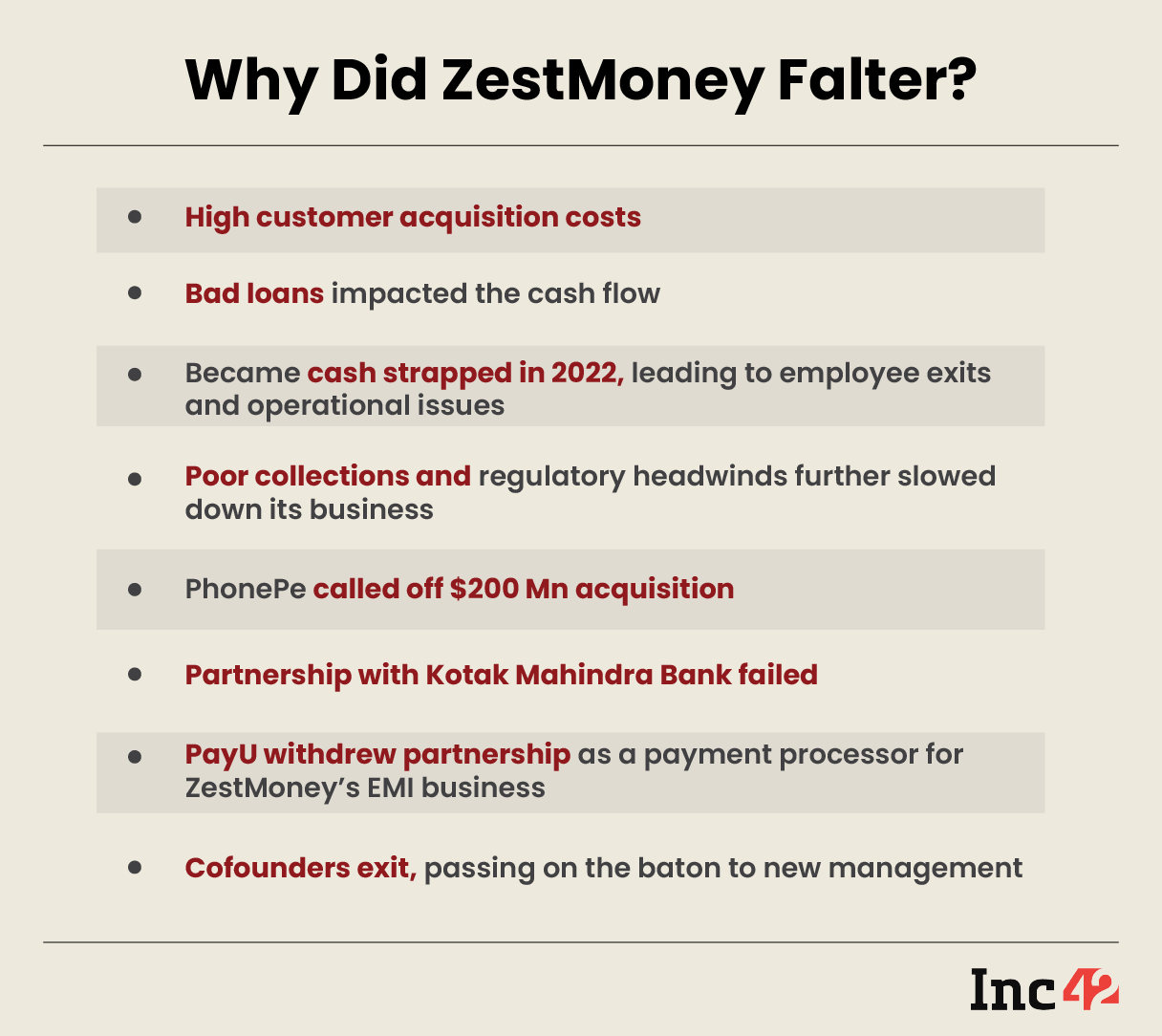

After the annulment of the PhonePe deal, ZestMoney lost its key partnerships and saw the exit of its founders. Can it rise again?

Shikha (name changed upon request), a mid-senior level employee at ZestMoney, once a leading buy-now-pay-later (BNPL) fintech startup, eagerly anticipated some positive news around appraisals in April this year. However, the HR department’s invitation to a town hall meeting brought an unexpected turn of events.

During the brief six-minute meeting, which was initiated by former CEO Lizzie Chapman, Shikha and her colleagues were taken aback when they learnt it could be their last gathering at the company. Chapman announced that ZestMoney would need to downsize the workforce by 20%, resulting in the termination of nearly 100 employees, due to the annulment of the fintech firm’s acquisition by PhonePe.

“It was the shortest town hall in ZestMoney’s history, followed by one of the most disorganised and unprofessional layoff exercises,” Shikha, the former ZestMoney employee said.

She further mentioned that the whispers about the company’s struggles and other issues, including a cash crunch, suddenly started making sense. The employees were left to bear the consequences as ZestMoney’s dream of a $300 Mn acquisition fell apart.

As per the latest updates, top sources told Inc42 that the ailing BNPL firm’s largest non-promoter shareholder PayU has also stopped integration of its payment gateway services with the ZestMoney, which has impacted the BNPL firm’s EMI business revenues from the major ecommerce marketplaces.

Besides, we were told, many lenders have revoked their partnership with ZestMoney, and the BNPL firm’s endeavour to forge new alliances with banks and NBFCs have failed to bear any fruit.

No endorsements here, but ZestMoney’s journey was better than this when it started out.

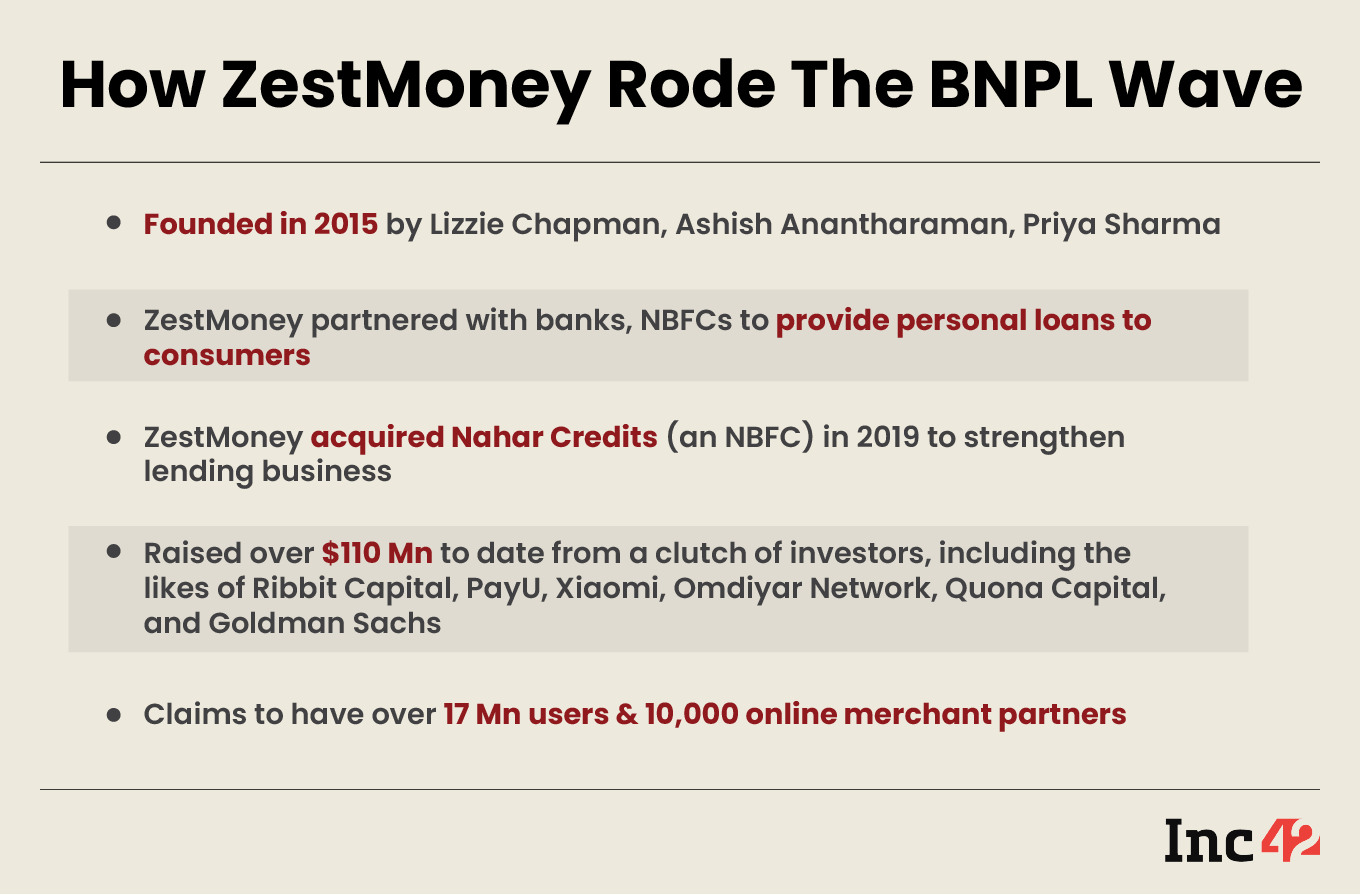

The fintech’s path to success once stood synonymous with India’s tryst with the BNPL market, which witnessed significant growth during the pandemic. As new-age companies lured young Indians with the option to make purchases and repay them in no-cost instalments over the following months, the BNPL sector soared. The timing was opportune, given that the purchasing power of many had been hit, presenting a ripe opportunity for disruption.

Hence, foreign investors started looking at fintech firms offering BNPL products as key investment bets. ZestMoney, too, leveraged the opportunity by raising funds at a valuation of $450 Mn.

However, since its Series C funding round in September 2021, in which it raised $50 Mn, ZestMoney has been facing a series of setbacks. These challenges have also led to the departure of the company’s three cofounders, Chapman, Priya Sharma, and Ashish Anantharaman, who handed over the reins of the company to new management.

Moving on, now that ZestMoney plans to be readying itself for the next round of funding under the new leadership, we (Inc42) have endeavoured to bring forth the challenges that have plagued the company since last year.

From incurring a 3X rise in losses to seeing the annulment of significant deals, along with regulatory hurdles and an alleged toxic corporate culture, ZestMoney, once an investor darling and a promising fintech firm, seems to be sitting on many daunting challenges.

With that said, let’s take a closer look at the issues that have afflicted the company, tarnishing its reputation.

Gaps In ZestMoney’s Biz Model

Adjust nahi Zest Karo. If you plan to visit ZestMoney’s mobile app or website, you may encounter many such taglines and slogans, which will make you feel that your next purchase is just a click away, with no upfront payments, easy instalments and no extra interest.

However, this playbook hardly proved beneficial in ZestMoney’s case, even though the company’s business model captured the interest of many investors as people queued up to avail small-ticket loans.

When reality hit, ZestMoney was already in a debt trap, triggered by multiple waves of loan defaults.

Well, just like many other players in the BNPL space, including LazyPay, Simpl, and axio, ZestMoney, too, was in the race to onboard millions of users, promising them easy finance, no interest payment and a hassle-free shopping experience.

Last year, the company claimed to have 17 Mn registered users, one of the largest networks of merchants and over 10,000 online partners. But these nifty numbers hardly helped the company tap any long-term sustainability, as, despite its seriousness to scale the user base, the loan default rate soon got out of hand.

According to several reports, ZestMoney incurred a bad debt rate of above 13% against a healthy BNPL loan default rate of 2-3%. Sources told us that ZestMoney had some delinquencies when it came to checking the creditworthiness of borrowers, which led to defaults.

However, the chief business officer (CBO) of ZestMoney, Mandar Satpute, has rubbished these reports, stating that the company’s NPAs have always been under 2.5%.

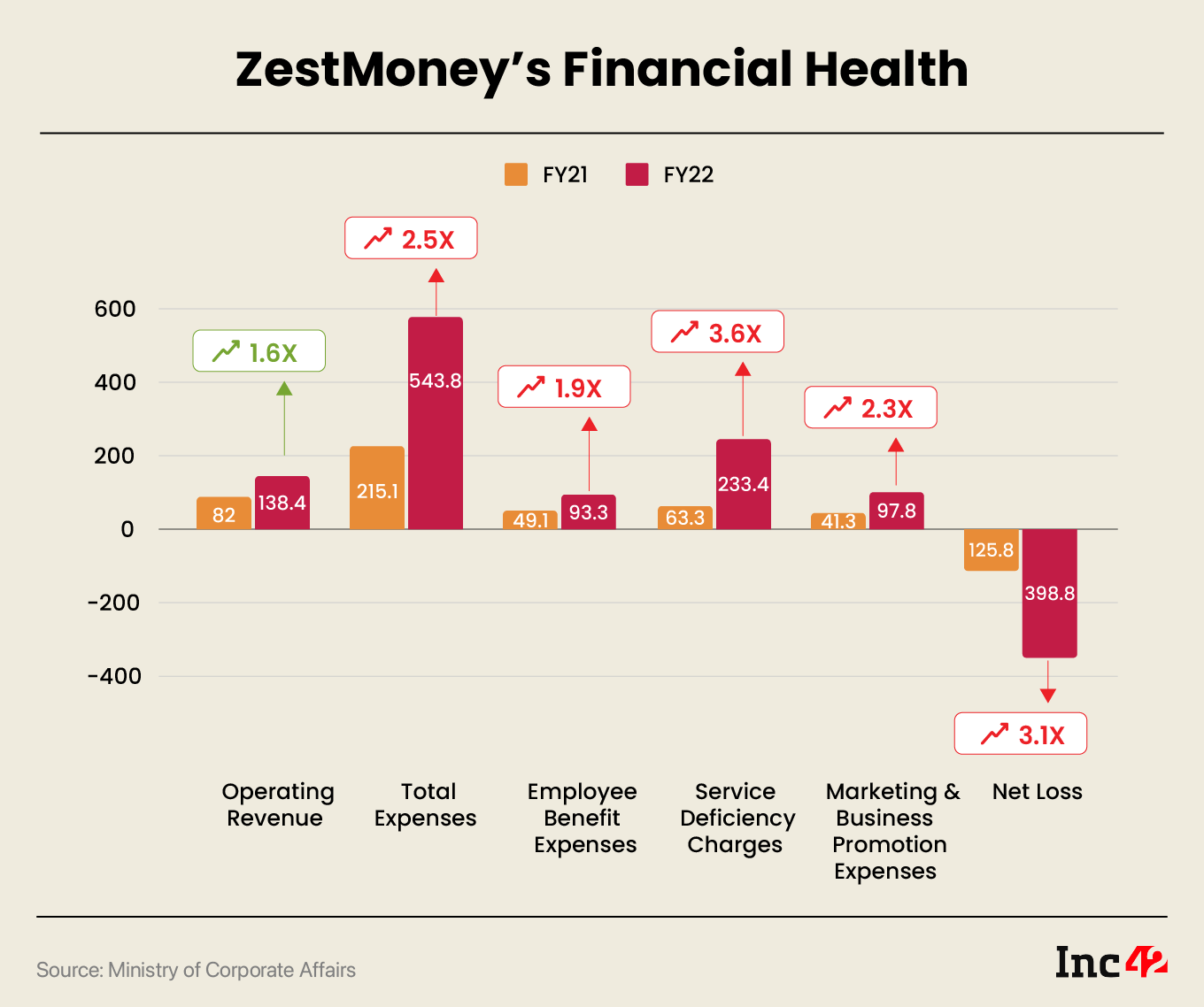

It is pertinent to note here that ZestMoney’s FY22 loss bloated 3X YoY to INR 398.8 Cr due to a sharp rise in expenses. The expenses were led by service deficiency charges, which jumped 3X to INR 233.4 Cr from INR 63.3 Cr in FY21. Interestingly, service deficiency charges denote the cost of bad loans, according to the company filings.

Additionally, the BNPL firm’s marketing and advertising expenses grew significantly by 2.3X to INR 97.8 Cr in FY22 from INR 41.3 Cr in FY21. Its EBITDA margin further worsened to -278.98% from -143.86% a year ago.

Sources with knowledge of the matter said that ZestMoney’s customer acquisition cost (CAC) in the form of cashback and other perks, too, skyrocketed to as much as INR 1,000 per customer.

“The company promised cashback, however, ZestMoney stopped offering the same to its customers as cash flow became a concern. As a result, it has been facing at least 2 to 3 consumer complaints slapped by borrowers, on a daily basis since last year for failing to fulfil the terms and conditions under its loan service agreement,” revealed a former third-party collection agent, who used to handle ZestMoney’s loan default cases.

He added that the cashback feature ZestMoney offered was part of its association with marketplaces like Nykaa, Amazon and Flipkart and could be availed at the end of the loan tenure.

Responding to our question about the number of consumer complaints, Satpute said that the BNPL firm was not facing any consumer cases. “These are only wild speculation,” the CBO said.

While there is no way to ascertain consumer complaints at the district level through online resources, a cursory glance at various online consumer complaint forums suggests that a majority of complaints against ZestMoney pertained to cashback.

ZestMoney’s loan model is dependent on its partnerships with various lenders, including banks and Non-Banking Finance Corporations (NBFCs), which underwrite loans basis on the credit risk evaluated by the BNPL firm.

Interestingly, most loans serviced by ZestMoney were on the books of its lending partners and not Nahar Credits, the NBFC it had acquired in 2019 for over INR 17 Cr.

Why Did ZestMoney Lose Its Key Partnerships?

Given that ZestMoney raised $50 Mn in its last round in 2021 and was burning more than what it was generating in revenues, it soon saw itself staring at the need to raise capital to keep itself afloat.

Hence, the BNPL fintech started looking for funds, even if it meant a potential acquisition. The troubled firm was in discussion with various fintech unicorns, including BharatPe and Pine Labs, for its acquisition, but the talks could not be walked.

It was then that ZestMoney prepared itself to take a valuation cut of more than 50% just to get acquired but to no avail, sources said.

Finally, Walmart-backed PhonePe reportedly pegged the ZestMoney acquisition deal at $200 Mn-$300 Mn, including its non-performing assets, lending service tech stack and the NBFC licence, which it had procured after acquiring Nahar Credits.

In November 2022, PhonePe offered an emergency credit line of $18 Mn to ZestMoney, including the option of a likely waiver as part of the acquisition deal.

However, PhonePe decided to part ways on account of due diligence concerns. Despite this, the fintech unicorn bought ZestMoney’s tech stack and absorbed 150 of its employees. This agreement also included paying an additional $8 Mn to ZestMoney.

Various reports suggest that the major reason why the PhonePe-ZestMoney deal did not pan out was because of its rising bad loans. However, sources close to the development alleged that PhonePe, during the due diligence, found that ZestMoney had inflated its FY23 revenue numbers and doctored customer acquisition costs, among other discrepancies involving loan disbursal numbers.

“ZestMoney’s EMI business was on the backfoot because of sub-par collections, therefore it could not even fetch the PhonePe acquisition deal,” a source said.

Inc42 sent a detailed questionnaire to ZestMoney on the PhonePe and ZestMoney deal failure. While ZestMoney negated all the claims made by our sources, it refused to comment on the reasons behind the failed acquisition, citing legal reasons.

Queries sent to PhonePe over the above inputs did not elicit any response at the time of publishing this story.

Meanwhile, nearly a dozen of its lending partners, including ICICI Bank, SBM Bank, IIFL and Northern Arc, stopped giving the BNPL firm any more credit exposure, according to an ET report.

This happened after PhonePe withdrew its acquisition offer and the three cofounders quit the company.

This reportedly also led to a decline in loan disbursals from INR 600 Cr at its peak in 2021 to INR 200 Cr annually a few months back.

Sources told Inc42 that ZestMoney even tried partnering with Kotak Mahindra Bank earlier this year to keep its lending business afloat, but the talks failed to see the light of day.

Responding to this, the ZestMoney CBO said that the company constantly remains in talks with banks and large NBFCs in the country for lending partnerships.

“A deal happens or doesn’t happen based on commercials and terms… Whether a deal happened with Kotak or not is not even newsworthy when ZestMoney has worked with over 30 lending partners, NBFCs, and banks, including ICICI and Tata Capital,” Satpute said.

Finally, PayU proved to be the last straw to break the camel’s back (in this instance, ZestMoney) as the payments processing partner ceased its collaboration with the BNPL firm across ecommerce marketplaces, including Amazon, Flipkart, Myntra and Nykaa, according to sources. “Although, the company is still working with Razorpay,” they added.

ZestMoney boldly claims on its website and mobile app that it partners with major etailers, including a clutch of D2C brands, merchants and offline stores, to offer no-cost EMI options on product purchases.

We tried to cross-check the company’s claims and found that even though its EMI payment option was available on various ecommerce marketplaces, we were unable to avail its service at the time of checkout while making a purchase a couple of days ago.

Requesting anonymity, a fintech analyst said that ZestMoney’s future and business model is in shambles, especially when PayU, which holds a 15.5% stake in ZestMoney, has stopped working with the BNPL firm.

In response to Inc42’s query, Satpute said, “Yes, we can confirm that PayU temporarily paused its partnership with ZestMoney. We are working on restarting the relationship with PayU. We would like to add that the other payment gateways and direct merchant relationships are business as usual.”

Meanwhile, a statement received by Inc42 from PayU read, “At PayU, we remain committed to offering the most comprehensive and convenient payment methods, including affordability options such as cardless EMI, to our valued merchant base. Currently, we are in discussions on various partnership areas with the ZestMoney leadership team.”

Notably, PayU became the lead investor in ZestMoney’s $6.5 Mn Series A round in February 2017.

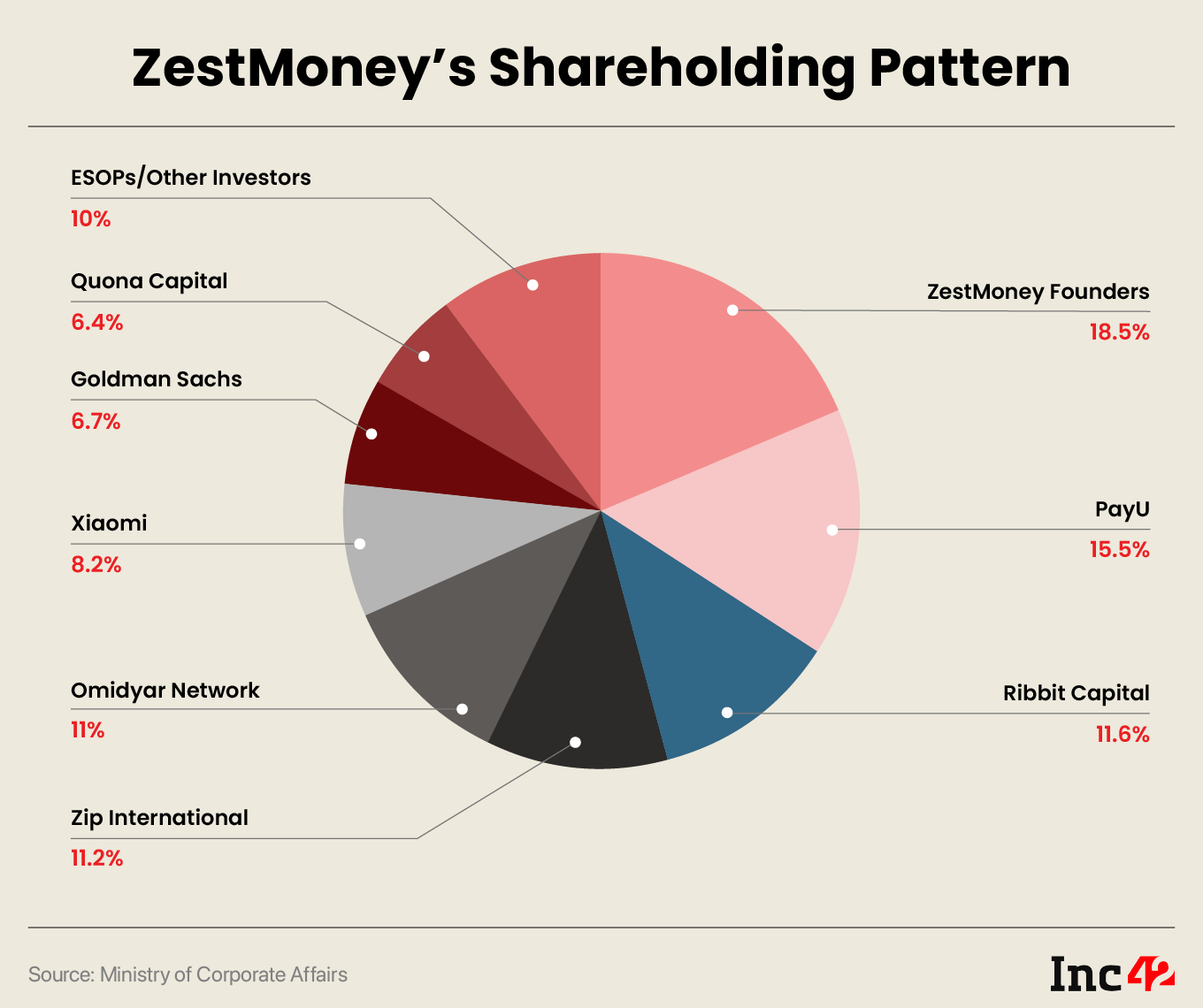

To date, ZestMoney has cumulatively raised $110 Mn from the likes of Ribbit Capital, PayU, Xiaomi, Omidyar Network, Quona Capital, and Goldman Sachs, among other investors.

ZestMoney’s Employees Pay The Price As Funding Taps Run Dry

At a time when the company is struggling to keep itself buoyant amid multiple acquisition talks and a bleak funding hope, its corporate culture has allegedly taken a hit. Nearly half a dozen former and current employees that we spoke with pointed out that there is a lot of imbalance inside the company since last year due to favouritism and job insecurity.

It is a well-known fact that startups do not offer typical 9 am to 5 pm jobs, as they require more energy and dedication to build and scale than any other established venture.

However, ZestMoney, according to its several employees, has taken this culture to an extreme by subjecting its workforce to toil for more than 15 hours a day.

“The company’s corporate culture is in a muddle right now. Team leaders are clearly told to make employees work for longer hours. Even the HR department doesn’t have a say in this. Further, things have become tougher ever since ZestMoney stopped hiring in April 2022 due to the paucity of funds. Teams have thinned down and the workload has increased. Many have additional responsibilities on the same compensation and are slogging due to the fear of losing their livelihood,” an ex-employee with knowledge of the matter said.

He further claimed that despite calling 2022 a no-appraisal year, some employees closer to the leadership team got fancy pay hikes.

“We expected that the performance metric will be the same for everyone, but there was no performance metric for some,” the ex-employee, who was associated with the firm for the last two years, said.

Responding to the allegations, ZestMoney’s Satpute said that there is no documentary evidence to suggest that the company engages in making its employees work for tediously long hours.

Meanwhile, the ex-employees we spoke with said that there was a lot of negativity brewing within the company, and no senior leader, including ex-CEO Lizzie and COO Priya Sharma, was accessible to address their concerns, except for erstwhile CTO Anantharaman.

“Whenever we approached the leadership, we were directed to the HR department,” they said. According to our sources, these growing issues have forced many employees to leave the company since last year.

Moving on, ZestMoney had to let go of more than 100 employees in April when the management addressed employees in a town hall saying that an email from HR means the end of employment.

“They simply ghosted us. But when we put up a strong face in front of the HR department, we were given a two months pay as full and final settlement and allowed us to keep our laptops,” another former senior employee at ZestMoney said.

However, Satpute claimed that on the retrenchment day (in April), the company held several town hall meetings with different teams, and senior management and HR personnel were available to provide counselling and support.

“We immediately offered placement support (as evidenced by the 130 people who went to PhonePe), and we helped place 90% of the remaining affected people within one month in over 50 organisations. All impacted employees were provided two months of compensation as well as full health care benefits for six months,” according to ZestMoney’s official statement.

What’s ZestMoney’s Rescue Plan?

At the time when ZestMoney’s rivals, Lazypay, Simpl, and KreditBee, have restructured their businesses to cut operational costs and curtail their losses, ZestMoney’s earliest backers, including Quona Capital, Australia-based Zip, and Omidyar Network, are looking to invest in the company.

ZestMoney’s CBO told Inc42 in an official statement that the company is expected to receive a capital infusion of $5 Mn-$10 Mn soon.

The focus for the business going forward will be on core digital EMI and personal loan products. We are not doing any SaaS and we have stopped the insurance business, the CBO said.

In an official statement, ZestMoney said it was expecting to raise funds in the next few weeks, and once it is done, the company will use the fresh capital to support its growth plans and boost profitability.

Satpute, also a former banker, has been closely working with banks and is looking at some lending partnerships. Besides, senior vice-president Abhishek Sharma and vice-president of finance and operations Mohit Chhajer have been promoted to leadership roles at ZestMoney.

At a time when there is so much happening in the company to keep it afloat, turnaround exercises and top-level rejig, ZestMoney cannot afford to ignore its workforce, which continues to serve in a highly uncertain corporate culture.

Also, the erstwhile cofounders continue to hold an 18.5% stake in the fintech, which raises questions if their departure was voluntary or not.

Whatever may be the case, ZestMoney’s new leaders seem to be glaring at several challenges on their long bumpy road to success.

[Edited by Shishir Parasher]