DroneAcharya was the biggest loser of the week, down more than 14%. It was followed by Nykaa, which fell nearly 14%

Only four out of the 14 new-age tech stocks ended the week higher, with RateGain emerging as the biggest winner, up 7%

Benchmark indices Nifty50 and Sensex rose 0.4% and 0.6%, respectively, this week

The sell-off in new-age tech stocks continued this week, with most of them reversing last week’s gains and ending in the red zone.

DroneAcharya, which has seen a sharp rise in its share price since its listing last month, emerged as the biggest loser this week. Despite the shares rising 5% to INR 179.05 on the BSE on Friday, the stock ended the week over 14% lower.

Meanwhile, beauty ecommerce platform Nykaa continued to remain under pressure, with the stock sliding nearly 14%.

Fintech giant Paytm shed last week’s gain to end the week 1.6% lower. However, many analysts continue to be positive about the stock. Earlier this week, brokerage Goldman Sachs, in a research note, said it expects the Vijay Shekhar Sharma-led company to achieve adjusted EBITDA profitability in the March 2023 quarter, two quarters ahead of its target.

Jigar S Patel, senior manager, technical analyst, at Anand Rathi Shares and Stock Brokers, said, “Paytm has been making higher highs and lower lows for over a month now. The stock is giving a clear buy signal with a target of about INR 585-INR 590.”

Meanwhile, just four out of the 14 stocks under our coverage ended the week higher, with RateGain Travel Technologies emerging as the biggest winner. MapmyIndia, EaseMyTrip and IndiaMART were the other stocks which gained on a weekly basis.

On the other hand, benchmark indices Nifty50 and Sensex ended slightly higher this week in the absence of any major cues. While Nifty50 inched up 0.4% to end Friday’s session at 18,027.65, Sensex rose 0.6% to settle at 60,621.77.

“Technically, on weekly charts, the Nifty has formed a long legged Doji candlestick, which is indicating non-directional activity. For the index, 18,000 or 20-day simple moving average would act as a sacrosanct support zone in the near future. And above the same, it could retest the level of 18,150-18,200. On the flip side, bearish sentiment is likely to accelerate below 18,000 and the index could slip to 17,850,” Amol Athawale, deputy vice-president, technical analyst, at Kotak Securities, said.

Now, let’s analyse the performance of the listed tech stocks from the Indian startup ecosystem.

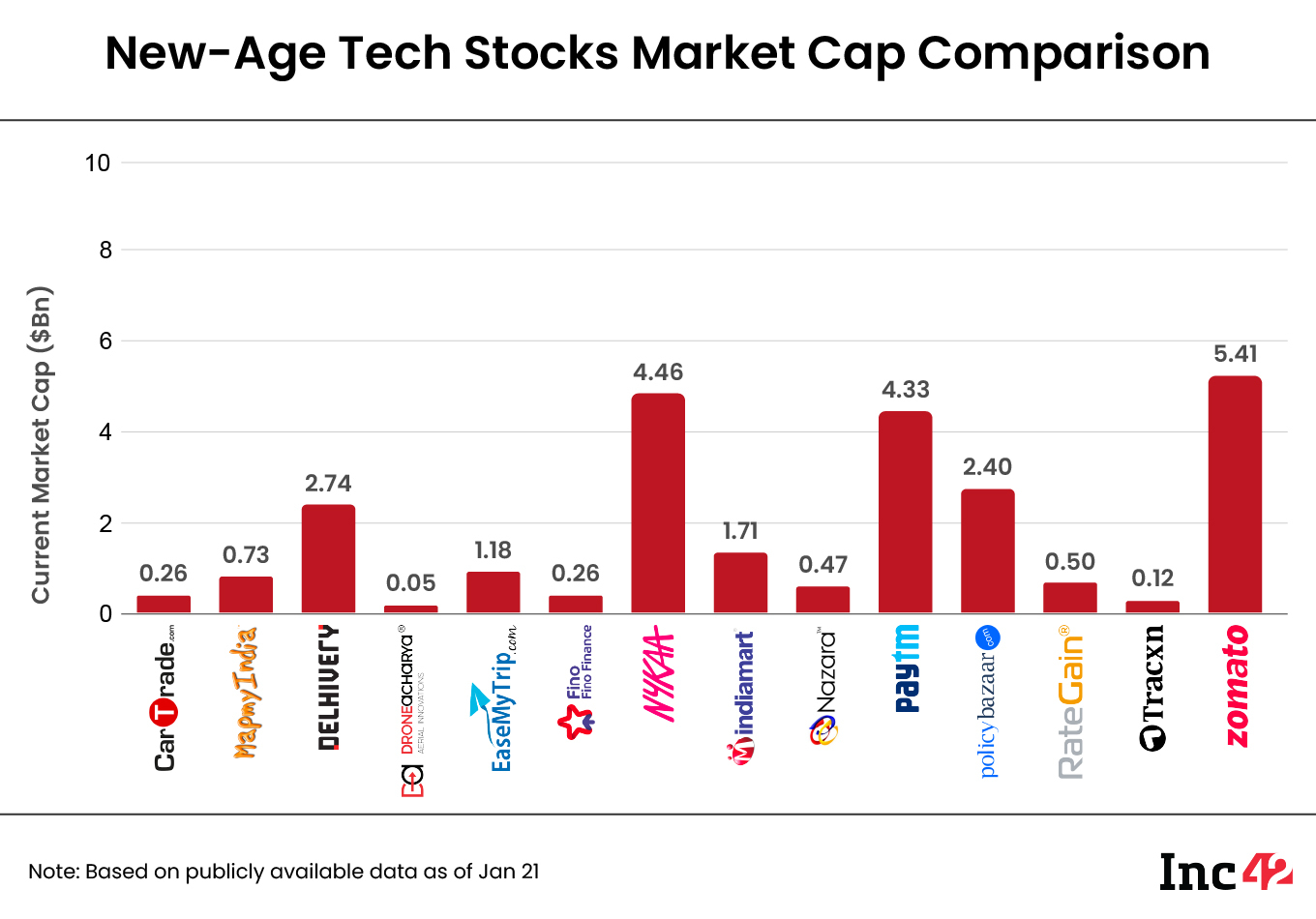

The 14 new-age tech stocks under our coverage ended the week with a total market capitalisation of $24.62 Bn as against $25.40 Bn last week.

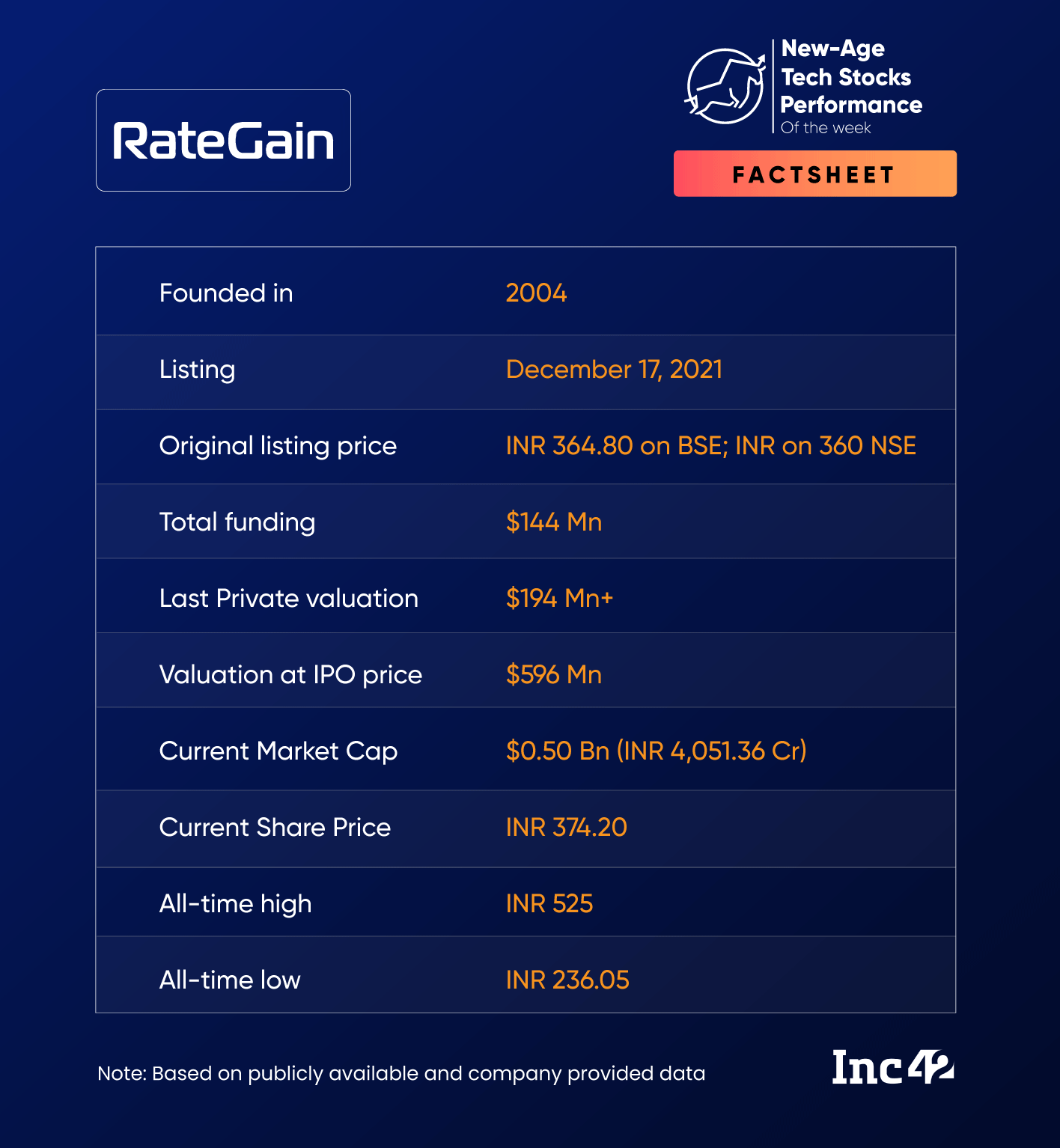

RateGain Biggest Gainer

Continuing its winning streak, RateGain emerged as the biggest gainer among the listed new-age tech stocks for the second consecutive week.

Shares of the traveltech SaaS startup have been rising since its announcement of the acquisition of data exchange platform Adara for $16.1 Mn (INR 134 Cr) at the beginning of this month.

Last week, the startup said that it completed the acquisition of Adara. However, its shares continued their upward journey this week as well, rising nearly 7%. The stock rose in four consecutive sessions this week, before declining marginally on Friday.

Earlier this week, RateGain also said that Greek airline SKY express has selected its SaaS solution AirGain to get real-time competitive pricing insights. AirGain provides an intuitive UI and real-time pricing intelligence to commercial teams of airlines to make pricing decisions.

RateGain was listed on the stock exchanges in December 2021, but the global tech sell-off in 2022 resulted in its shares falling more than 23% during the year. However, the shares once again crossed their listing price on the BSE and the NSE this week.

“RateGain is looking strong on the technical charts. It had a range breakout about two-and-a-half weeks ago and has been rising since then. It is a good buy at this level as the stock can go up to INR 425-INR 430,” Patel said.

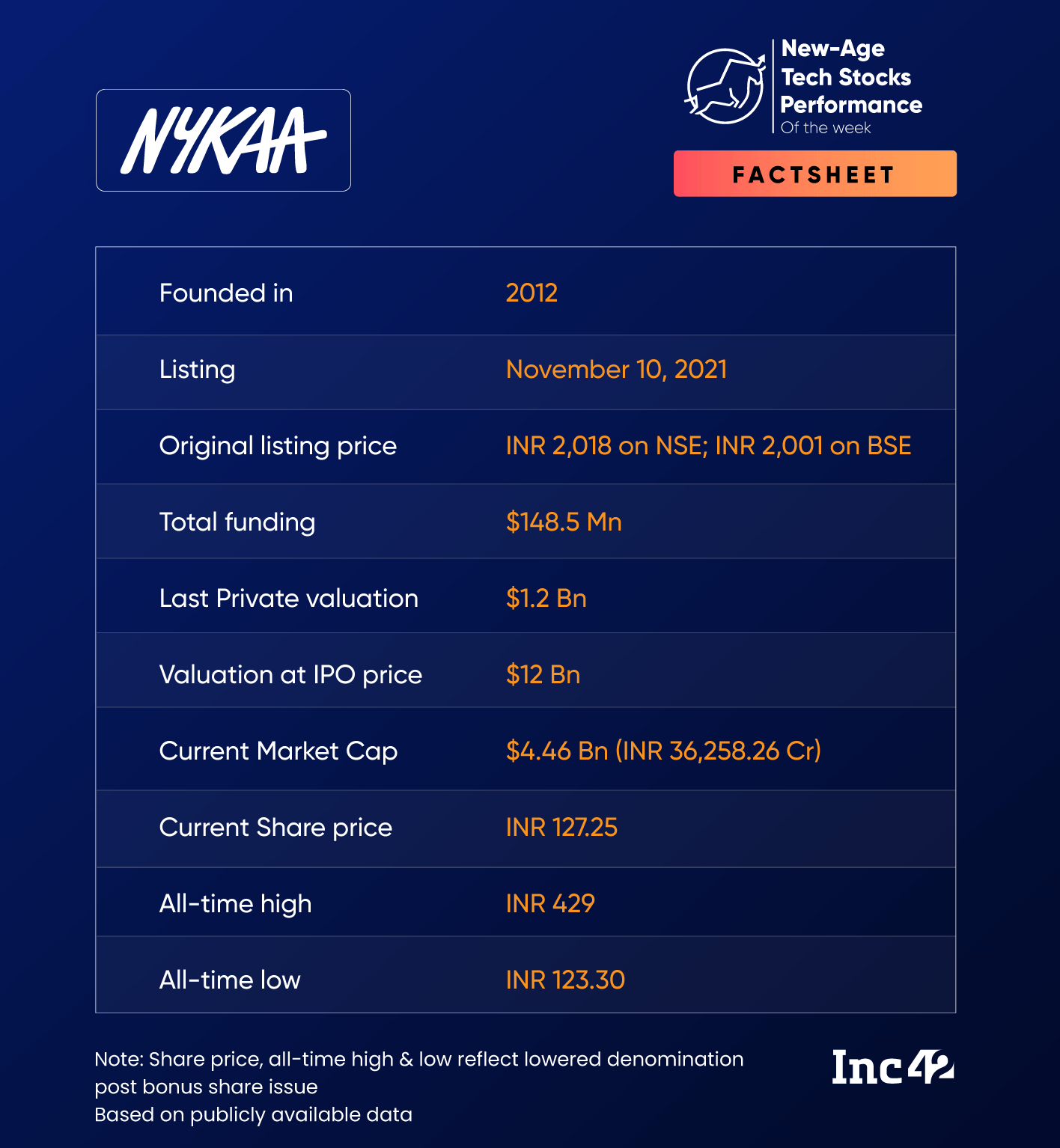

Nykaa’s Horror Show Continues

There was no relief for Nykaa this week as well, as its shares continued to fall. After falling 3.6% last week, the beauty ecommerce platform’s shares plunged nearly 14% this week.

Nykaa was one of the worst hit new-age tech stocks in 2022, with its shares falling over 60%. Besides the global macroeconomic headwinds, the expiry of the lock-in period for its pre-IPO investors in November 2022 also hit Nykaa last year. The trend has continued in 2023 as well, with its major investors offloading a large number of shares. The stock fell in four out of the five sessions this week, hitting a record low of INR 123.30 intraday on Wednesday.

“Nykaa is looking very bearish right now and the stock can fall even further. It is facing historical resistance at INR 140 and any chances of a meaningful rally are likely only after it crosses this level,” Patel said.

However, Nykaa received a shot in the arm this week from positive commentaries by a couple of brokerages. In a research note, HSBC said that the startup’s valuations are even more “appealing” now and under-appreciate the structural growth opportunity in the beauty and personal care (BPC) space. Maintaining a ‘buy’ rating, it adjusted the target price to INR 361.67 for the stock.

Meanwhile, ICICI Securities also upgraded Nykaa to ‘Add’ from ‘Hold’. The brokerage said that Nykaa presents a combination of the largest BPC business in a growth market, good profitability metrics, prudent capital allocation, and is omni-channel in the ‘true sense’ (going online to offline). It has a target price of INR 145 on the stock.

IndiaMART’s Impressive Q3 Show

Shares of B2B marketplace IndiaMART ended over 2% higher this week, as the startup reported positive numbers for the third quarter of the financial year 2022-23 (FY23).

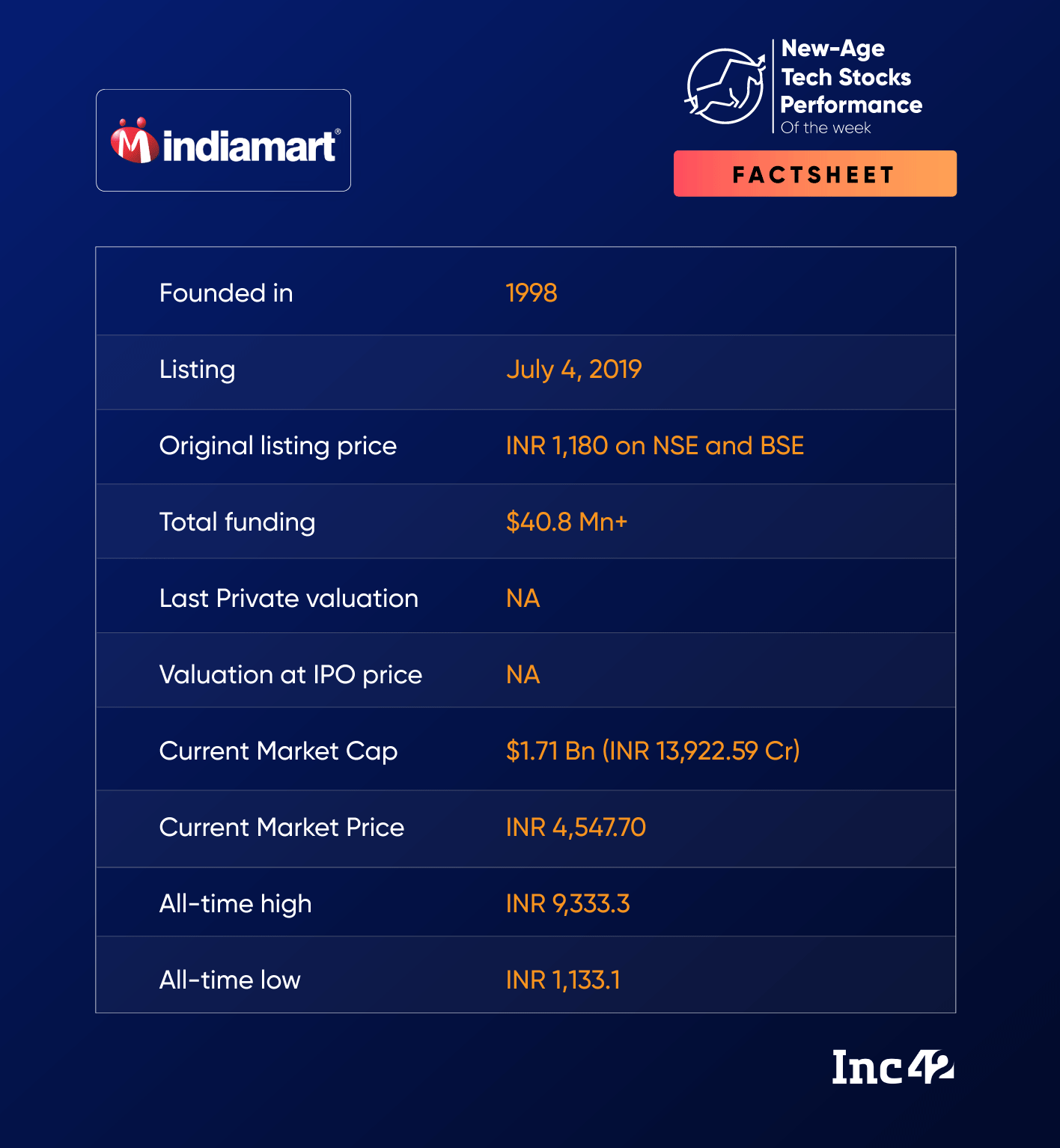

While shares of IndiaMART rose over 1% each in the first two sessions of the week, the stock ended in the red in the next two sessions. However, the shares gained 1.6% on Friday to end at INR 4,547.70 on the BSE on the back of the company reporting an over 60% year-on-year (YoY) rise in its Q3 net profit.

Led by a 24% growth in its paying subscription suppliers, IndiaMART posted a profit of INR 113 Cr in Q3 FY23 as against INR 70 Cr in the year-ago quarter. Operating revenue surged 34% YoY to INR 251 Cr.

IndiaMART is among the few listed Indian tech startups whose shares are trading above their listing price. The B2B marketplace’s shares are currently trading over 285% higher than its listing price of INR 1,180 on the BSE and the NSE.