Online gaming, horse racing, and casinos will be taxed on full face value at the rate of 28%: FM Nirmala Sitharaman

GST will now be applicable to gross revenue or total prize pool with no distinction between games of skill and games of chance

The online gaming industry reacted strongly to the move, saying it would “destroy a significant portion of the successful companies” in India’s startup ecosystem

In a big blow to online gaming startups like Dream11, MPL, Games24x7, among others, the GST Council on Tuesday (July 11) agreed to levy tax at the rate of 28% on online gaming.

After consultations and discussion on the issue for over two years, the Council, at its 50th meeting, decided to go ahead with the Group of Ministers’ (GoM’s) suggestion of levying a GST of 28% on online gaming, horse racing and casinos.

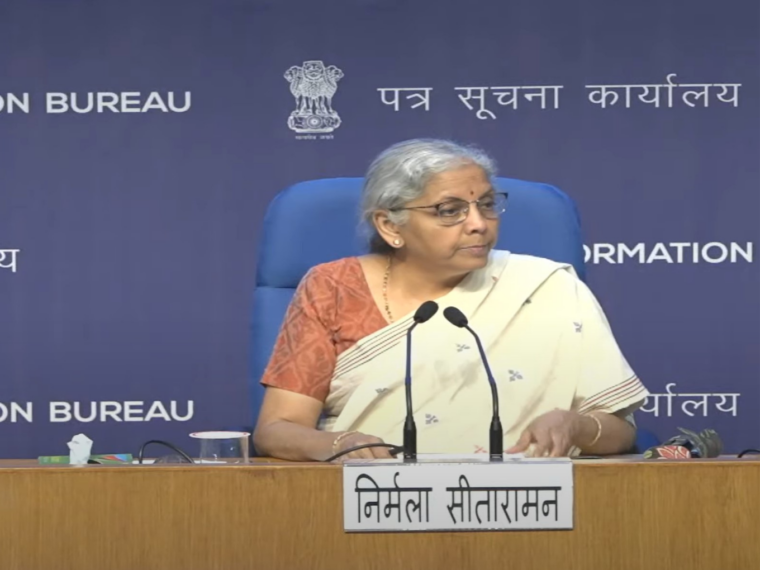

“There will be some amendment to the GST law to include online gaming in it. Online gaming, horse racing, and casinos will be taxed at 28% and taxed on full face value,” Finance Minister Nirmala Sitharaman said in a press conference after the meeting of the Council.

GST will now be applicable to gross revenue or total prize pool with no distinction between games of skill and games of chance.

“The discussion also looked at what is skill-based and what is chance-based. Whatever be the decision on (what) each of the game is – either skill or chance-based, or being both or being neither – is not what we are looking at. We are purely looking at that which is being taxed,” said Sitharaman.

The government will also amend Schedule 3 of the GST Act to bring online gaming into the actionable claim list.

In simple words, an actionable claim refers to a claim of debt.

Industry Blasts The Move

The online gaming industry reacted strongly to the move to levy GST at the rate of 28%, saying it would “destroy a significant portion of the successful companies” in India’s startup ecosystem.

“GST on GGV (gross gaming value) is a self goal that will kill India’s skilled online games industry. It negates all the good work that the Modi government has done to support the Skilled Online Gaming (SOG) industry – appointing MeitY as the nodal ministry for this industry, notifying rules that now govern the industry, allowing for the formation of self-regulating bodies (SRBs) to regulate the industry, addressing the ambiguity in TDS deduction rules,” said Amrit Kiran Singh, chief strategy advisor to the founders of Gameskraft.

“Today’s decision at the GST Council is not in national interest as it will destroy a significant portion of the successful companies in India’s startup ecosystem. Unfortunately, it also appears to show that the different limbs of the government are not in sync,” Singh added.

Meanwhile, Roland Landers, CEO of The All India Gaming Federation, called the GST Council’s decision “unconstitutional, irrational, and egregious”.

“The decision ignores over 60 years of settled legal jurisprudence and lumps online gaming with gambling activities. This decision will wipe out the entire Indian gaming industry and lead to lakhs of job losses and the only people benefitting from this will be anti-national illegal offshore platforms,” said Landers.

According to Joy Bhattacharjya, DG of the Federation of India Fantasy Sports (FIFS), besides causing irreversible damage to the industry and loss of revenue to the exchequer, the 28% tax rate would result in loss of employment for lakhs of skilled engineers.

“Needless to add, this decision will have a chilling effect on the $2.5 Bn of FDI already invested by investors and jeopardise potentially any further FDI in the sector. Further, this decision will shift users to illegal betting platforms, leading to user risk and loss of revenue for the government. We humbly request the GST Council and the Government of India to reconsider this decision,” Bhattacharjya added.

The Timeline

Early last year, the Union Ministry of Finance formed the GoM to look into matters related to the GST regime covering online gaming, casinos, and race courses. Chaired by Meghalaya chief minister, the GoM comprised ministers from seven other states – Goa, Uttar Pradesh, Tamil Nadu, West Bengal, Telangana, Gujarat and Maharashtra.

The idea was to bring uniformity in the GST rate on various aspects of gaming. So far, while a tax rate of 18% was levied on the commission collected by the online gaming platforms for each game not involving betting or gambling, the rate was 28% on online games involving betting or gambling.

On horse racing, GST was levied at 28% on the total bet value.

However, there was a demand to lower it all to 18%.

Early last year, it started becoming more obvious that the Centre intended to keep the rate at 28% to discourage gambling and betting-related games. In November 2022, reports said that GoM would submit a report to the GST Council on the matter.

The impending move faced criticism from several industry bodies and experts. However, after several months of discussions on the matter, most states agreed on the 28% GST but Goa opposed it.

With Goa refusing to agree to 28% GST, the GoM asked the GST Council to take a final call.

Responding to a question, Sitharaman said the government wants to promote the online gaming industry, like it promotes other sectors. However, the tax rate for the industry cannot be lower than that on essential goods.

She said the final decision was taken after consultation with all states, including Goa, which is heavily dependent on the casino business for tourism.